The most oversold stocks in the consumer staples sector presents an opportunity to buy into undervalued companies.

The RSI is a momentum indicator, which compares a stock’s strength on days when prices go up to its strength on days when prices go down. When compared to a stock’s price action, it can give traders a better sense of how a stock may perform in the short term. An asset is typically considered oversold when the RSI is below 30, according to Benzinga Pro.

Here’s the latest list of major oversold players in this sector, having an RSI near or below 30.

Instacart (NASDAQ:CART)

- On Jan. 27, Stifel analyst Mark Kelley maintained CART with a Buy and lowered the price target from $49 to $46. The company’s stock fell around 18% over the past month and has a 52-week low of $34.78.

- RSI Value: 29.3

- CART Price Action: Shares of Instacart fell 2% to close at $37.08 on Thursday.

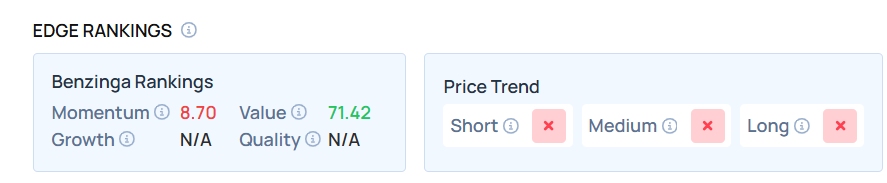

- Edge Stock Ratings: 8.70 Momentum score with Value at 71.42.

Coffee Holding Co., Inc. (NASDAQ:JVA)

- On Oct. 7, Coffee Holding announced plans to close its Comfort Foods North Andover, Massachusetts manufacturing facility. The company’s stock fell around 18% over the past five days and has a 52-week low of $2.76.

- RSI Value: 20

- JVA Price Action: Shares of Coffee Holding fell 14.9% to close at $3.20 on Thursday.

- Benzinga Pro’s charting tool helped identify the trend in JVA stock.

22nd Century Group Inc (NASDAQ:XXII)

- On Nov. 4, 22nd Century Group reported worse-than-expected third-quarter financial results. “The third quarter represents the launch point for a full pivot to a branded products strategy that will drive our future. Multiple brands of our VLN® products are now available for purchase, our store count is increasing every month, and we are securing new distribution agreements to expand our reach,” said Larry Firestone, CEO of 22nd Century Group. The company’s stock fell around 36% over the past five days and has a 52-week low of $7.17.

- RSI Value: 27

- XXII Price Action: Shares of 22nd Century Group fell 10.9% to close at $7.69 on Thursday.

- Benzinga Pro’s signals feature notified of a potential breakout in XXII shares.

BZ Edge Rankings: Find out where other stocks stand—explore the full comparison now.

Photo via Shutterstock

Recent Comments