Humana Inc. (NYSE:HUM) has emerged as a top-ranked value play within the healthcare sector following its stock price’s sharp 26.64% year-to-date decline.

Valuation Vs. Momentum

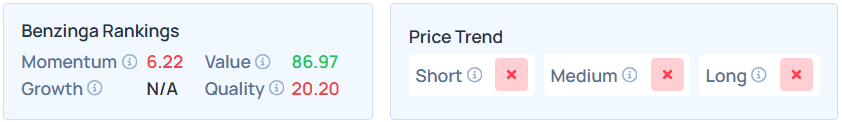

After a significant sector-wide sell-off triggered by the Donald Trump administration’s proposed flat Medicare Advantage (MA) rates, Humana’s value Score on the Benzinga Edge’s Stock Ranking dashboard surged from 77.65 to 86.97.

This percentile-ranked metric indicates that the company is now priced attractively relative to its fundamental earnings, assets, and sales compared to its peers.

Despite the jump in value, other Benzinga Edge indicators highlight the ongoing risks. Humana’s momentum score remains at a low 6.22, and its quality score sits at 20.20, reflecting poor operational efficiency relative to historical profitability metrics.

Furthermore, the stock’s price trend is currently flagged as negative across short, medium, and long-term horizons, indicating a sustained downward trajectory over the past year.

A ‘Shock To The System’

The downturn was catalyzed by a proposal from the Centers for Medicare and Medicaid Services (CMS) to increase net average payments for 2027 by a mere 0.09%.

This figure starkly missed Wall Street expectations of a 4% to 6% hike, which analysts from Mizuho described as a “shock to the system” that could delay a sector-wide turnaround until at least 2026.

As a major insurer heavily reliant on Medicare Advantage, Humana’s market value was disproportionately impacted compared to more diversified rivals like UnitedHealth Group Inc. (NYSE:UNH).

Earnings Outlook And Recovery

The disconnect between flat government funding and rising medical utilization costs has led analysts at Argus Research to warn of a potential 15-20% hit to earnings if the rates are finalized in April without adjustments.

While the current value score suggests an entry point for contrarian investors, the broader sector may face a “pocket” of stagnation as insurers negotiate with the administration to bake rising costs into future rates.

HUM Drops Nearly 26% In 2026

Shares of HUM have slumped 24.08% over the last month and 25.64% in 2026 so far. It was down 24.78% over the last six months and 33.76% over the year.

On Thursday, the stock closed 1.37% higher at $196.67 apiece and fell 0.70% in after-hours.

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

Image via Shutterstock

Recent Comments