Carvana Co (NYSE:CVNA) shares are up on Thursday, rebounding following weakness driven by a report released by Gotham City Research. The report alleges accounting issues and inflated earnings, which has raised concerns among investors. Here’s what investors need to know.

- Carvana stock is surging today. What’s behind CVNA gains?

Gotham City Research Alleges $1B Earnings Overstatement

Gotham City Research claims that Carvana overstated its earnings for 2023-2024 by more than $1 billion and is overly reliant on related parties for financial stability. The report also predicts that Carvana’s upcoming 10-K filings will be delayed and may require restatements, further complicating the company’s financial outlook.

A Carvana spokesperson told Benzinga the report is “inaccurate and intentionally misleading,” adding that all related-party transactions are properly disclosed. The company also confirmed it plans to release its 2025 financial results on Feb. 18.

Why Carvana’s Mixed Signals Are Telling

Carvana stock is currently trading 4.2% below its 20-day simple moving average (SMA) but is 11.4% above its 100-day SMA, demonstrating some longer-term strength. Shares have increased 67.05% over the past 12 months and are currently positioned closer to their 52-week highs than lows.

The RSI is at 40.28, which is considered neutral territory, while MACD is below its signal line, indicating bearish pressure on the stock. The combination of neutral RSI and bearish MACD suggests mixed momentum.

- Key Resistance: $485.50

- Key Support: $430.50

Carvana’s Business Model

Carvana is an e-commerce platform for buying and selling used cars. The company derives revenue from used vehicle sales, wholesale vehicle sales and other sales and revenues, including sales of loans originated and sold in securitization transactions or to financing partners.

Analysts See Growth Ahead

Investors are looking ahead to the next earnings report in February.

- EPS Estimate: $1.11 (Up from $0.56 YoY)

- Revenue Estimate: $5.24 billion (Up from $3.55 billion YoY)

- Valuation: P/E of 93.2x (Indicates premium valuation)

Analyst Consensus & Recent Actions: The stock carries a Buy Rating with an average price target of $475.67. Recent analyst moves include:

- JPMorgan: Overweight (Raises Target to $510.00) (Jan. 28)

- Wells Fargo: Overweight (Raises Target to $525.00) (Jan. 27)

- Barclays: Overweight (Raises Target to $530.00) (Jan. 21)

Valuation Insight: While the stock trades at a premium P/E multiple, the strong consensus and 98% expected earnings growth suggest analysts view this growth as justification for the upside to analyst targets.

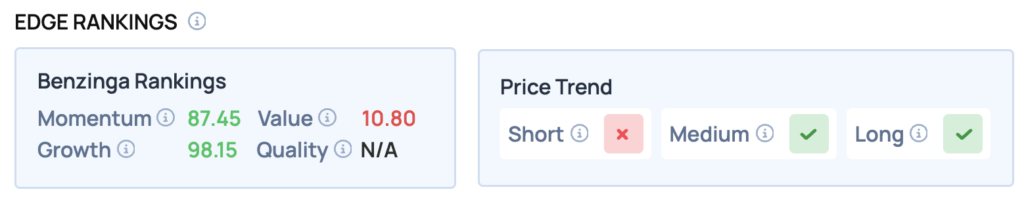

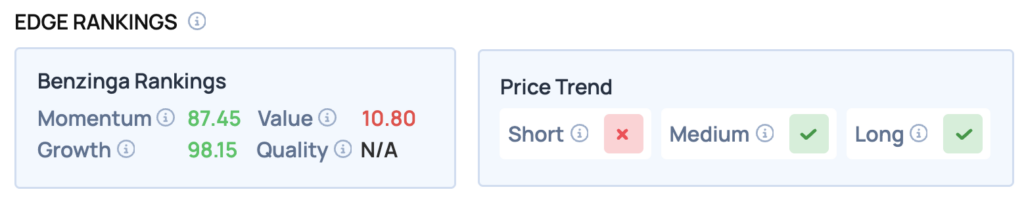

Benzinga Edge Rankings

Below is the Benzinga Edge scorecard for Benzinga Edge scorecard for Carvana, highlighting its strengths and weaknesses compared to the broader market:

- Value Rank: 10.8 — The stock is trading at a steep premium relative to peers.

- Growth Rank: 98.15 — Indicates strong growth potential.

- Momentum Rank: 87.45 — Stock is outperforming the broader market.

CVNA Shares Rebound Thursday

CVNA Price Action: Carvana shares were up 3.48% at $422.43 at the time of publication on Thursday, according to Benzinga Pro data.

Image: Shutterstock

Recent Comments