GE Vernova Inc. (NYSE:GEV) reported mixed fourth-quarter results on Wednesday.

For the quarter, GE Vernova reported revenue of $10.956 billion, up 4% from $10.559 billion, and sales exceeded an analyst estimate of $10.213 billion. Fourth-quarter EPS of $2.79 missed a $3.18 estimate, while diluted GAAP EPS rose to $13.39 from $1.73 a year earlier.

“We delivered strong financial performance in 2025 with continued momentum in Power and Electrification while focusing on what we can control in Wind. We increased our backlog to $150 billion, with better equipment margins, and are entering 2026 with significant momentum,” CEO Scott Strazik said.

GE Vernova raised its 2026 revenue outlook to $44 billion to $45 billion, increased free cash flow guidance to $5.0 billion to $5.5 billion, and said it now expects 2028 revenue of $56 billion.

GE Vernova shares rose 0.8% to $716.93 in pre-market trading.

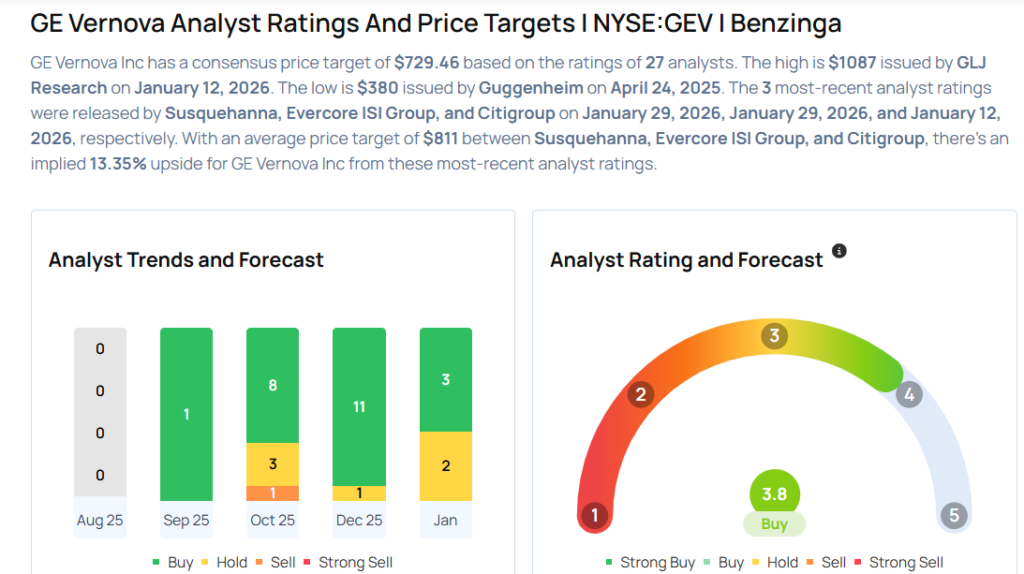

These analysts made changes to their price targets on GE Vernova following earnings announcement.

- Evercore ISI Group analyst James West maintained GE Vernova with an Outperform rating and raised the price target from $860 to $905.

- Susquehanna analyst Charles Minervino maintained the stock with a Positive and raised the price target from $800 to $820.

Considering buying GEV stock? Here’s what analysts think:

Photo via Shutterstock

Recent Comments