Right on cue, President Donald Trump intensified his pressure campaign against the Federal Reserve on Thursday, calling for immediate rate cuts and accusing Chair Jerome Powell of damaging the U.S. economy and national security by keeping borrowing costs elevated.

In a statement released on social media early Thursday, Trump claimed the Fed Chair is “costing America hundreds of billions of dollars a year in totally unnecessary and uncalled for interest expense.”

“He is hurting our Country, and its National Security,” Trump wrote.

“We should have a substantially lower rate now that even this moron admits inflation is no longer a problem or threat.”

Trump indicated that the strength of the U.S. economy, particularly due to revenues from tariffs, justifies lower borrowing costs and that the U.S. should be paying the “lowest interest rate of any country in the world.”

The comments followed Powell’s press conference on Wednesday, where the Fed held rates steady at 3.5%–3.75% and signaled no rush to ease policy further.

Powell emphasized the central bank is “well positioned” after three rate cuts since September and said decisions would remain data-dependent, while also forcefully defending the Fed’s independence from political pressure.

Precious Metals Soar As Powell Downplays Their Economic Significance

The precious metal rally accelerated following Powell’s attempt to downplay the macroeconomic signal from gold and silver prices.

During Wednesday’s press conference, Powell said he does not draw broader conclusions from moves in individual assets and rejected the idea that surging metals prices reflect a loss of Fed credibility.

“If you look at where inflation expectations are, our credibility is right where it needs to be,” Powell said, answering questions related to whether the Fed is inferring any economic signal from the rally in precious metals.

“We don’t get spun up over particular asset change prices, although we do monitor them, of course.”

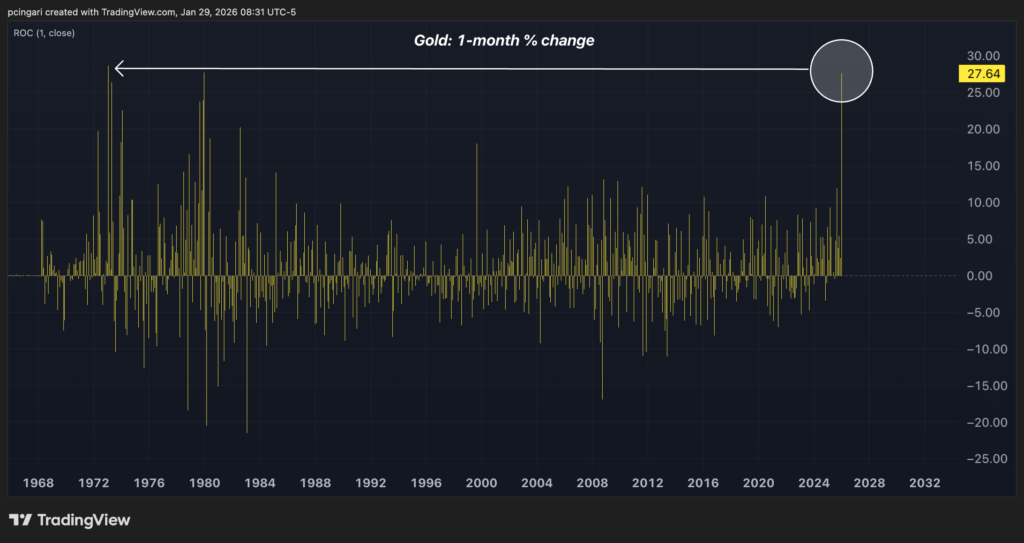

On Thursday, gold prices surged 2.2% to a record above $5,530 per ounce, extending gains for an eighth consecutive session and pushing the yellow metal up roughly 28% for the month, on track for its strongest monthly performance since January 1973.

Silver jumped 1.8% past $118 per ounce, continuing a parabolic move that has put the metal on pace for its best month since the 1864 American Civil War.

During premarket trading in New York, the VanEck Gold Miners ETF (NYSE:GDX) was up over 1%, on track to extend its year-to-date gains to 30% – the fund’s best month since April 2020.

Photo: Shutterstock

Recent Comments