As Exxon Mobil Corp. (NYSE:XOM) prepares to report fourth-quarter earnings on Jan. 30, the energy giant faces a complex landscape defined by softening crude prices and a sudden geopolitical shift.

While lower upstream realizations are expected to weigh on results, analysts forecast that robust refining and record production volumes in Guyana and the Permian Basin will provide a critical earnings buffer.

Refining Resilience Meets Market Headwinds

Wall Street consensus estimates project fourth-quarter Earnings Per Share (EPS) of $1.68 on revenue of approximately $82.28 billion, as per Benzinga.

This follows a strong third quarter where the company delivered $7.5 billion in earnings, driven by record refinery throughput and structural cost savings that have now surpassed $14 billion since 2019.

Despite a negative outlook from some bears citing declining margins, ExxonMobil’s integrated model is expected to shine.

Josh Brown, CEO of Ritholtz Wealth Management, told CNBC that he views the stock’s recent performance as a “breakout,” noting it has decoupled from falling oil prices.

Brown argues XOM acts as a necessary portfolio hedge against inflation, stating that despite crude dropping 5% recently, the stock’s internal momentum remains strong.

Venezuela Wildcard

Beyond the balance sheet, investors are laser-focused on a developing geopolitical opportunity.

Following reports that the Trump administration is urging U.S. oil majors to rebuild Venezuela’s energy sector, ExxonMobil leadership has signaled openness to evaluating a re-entry. While Venezuela holds the world’s largest proven oil reserves, experts remain cautious.

Baron Lamarre, former head of trading at Petronas, warns that “political promises alone cannot protect assets” from historical risks of expropriation, suggesting that frameworks like “tokenization” are needed to secure investments.

In a conversation with Schwab Network, Ted Parkhill, CEO of Inclined Investment Advisors, and Brandon Win, a wealth advisor at Karen Financial Group, agree that while big firms like Exxon are best positioned for this “infrastructure play,” the situation remains an “uncertainty story.”

Parkhill remains fundamentally bearish on oil due to oversupply, viewing Venezuela primarily as a source of further volatility rather than immediate value.

2026 Growth Trajectory

Looking ahead, the company is doubling down on its “League of Our Own” strategy.

Management reaffirmed that 10 major project startups from 2025—including the Yellowtail development in Guyana—are on track to contribute over $3 billion in additional earnings in 2026.

With a $20 billion annual share buyback program intact, ExxonMobil remains positioned to return significant value to shareholders despite market volatility.

XOM Gains Over 14% YTD

Shares of XOM have jumped 15.51% over the last month and 14.33% in 2026 so far. It was up 23.46% over the last six months and 27.34% over the year.

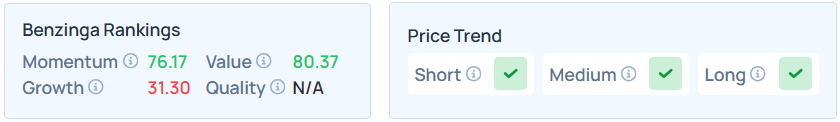

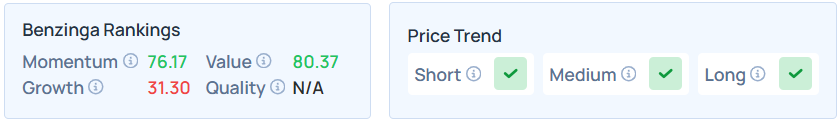

Benzinga’s Edge Stock Rankings indicate that XOM maintains a strong price trend over the short, medium, and long terms, with a poor growth ranking.

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

Photo courtesy: Ken Wolter/Shutterstock

Recent Comments