Economist Peter Schiff issued a stark warning regarding the state of the current U.S. equity markets, following a record rally in gold spot prices.

‘Historic Bear Market’ Amid Gold’s Record Rally

On Wednesday, in a post on X, Schiff highlighted gold’s record rally, calling it the “biggest one-day” rise against the U.S. Dollar in history, as the spot prices of the yellow metal soared to new record highs of $5,590 per ounce.

In addition to gold’s surging value against the U.S. Dollar, Schiff also pointed to the relative weakness in stocks, noting that “the Dow is now worth just 9 ounces of gold,” which he said is “its lowest level since 2013.” He added that the index is “nearly 80% below its record high priced in gold in 1999.”

Warning investors against focusing solely on nominal price levels, Schiff said, “Don’t be fooled by inflation,” while concluding by saying, “This is a historic bear market!”

By measuring how many ounces of gold are needed to buy the Dow, the ratio reflects whether equities are gaining or losing purchasing power relative to a hard asset, even if stock indexes appear elevated in nominal terms.

For instance, in 1999, the Dow Jones Industrial Average traded at 5117.12 points, while gold was at $285.65 an ounce, which means the Dow was worth 17.9 ounces of gold at the time.

The same ratio is now down to 8.8, with the Dow at 49,015.60 points and gold at $5,556.12 per ounce, a level Schiff noted remains significantly below its 1999 high when priced in gold, especially following the commodity’s monumental rally over the past year.

Gold Surges Amid Mounting Fiscal, Geopolitical And Monetary Concerns

Gold spot prices continued to rally on Wednesday despite the Federal Reserve leaving interest rates unchanged during the January FOMC meeting.

This comes amid relentless stockpiling by central banks across the world, at roughly 60 tons per month, as the commodity overtakes the Euro as the second-largest reserve asset, now only trailing the U.S. Dollar. This is the result of mounting fiscal, geopolitical and currency credibility concerns over the past year.

The precious metal received additional momentum after President Donald Trump brushed aside concerns regarding the U.S. Dollar sliding to a four-year low, saying that it should “seek its own level.”

Trump also said the dollar’s decline helps U.S. companies compete with Japanese and Chinese rivals, a remark that markets interpreted as signaling tolerance for a weaker currency.

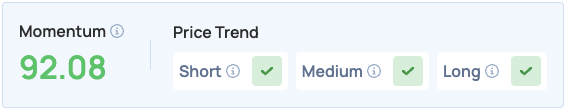

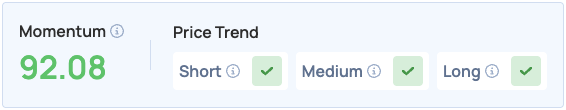

The SPDR Gold Trust (NYSE:GLD), which tracks the price of gold, was up 3.88% on Wednesday, closing at $494.56 a share, and is up 2.72% overnight. The fund scores high on Momentum in Benzinga’s Edge Stock Rankings, with a favorable price trend in the short, medium and long terms.

Photo Courtesy: CHUYKO SERGEY on Shutterstock.com

Recent Comments