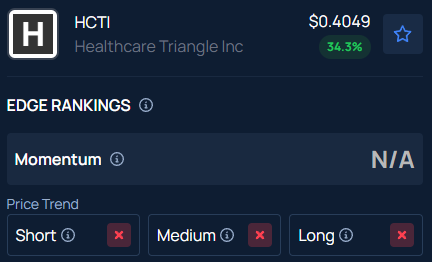

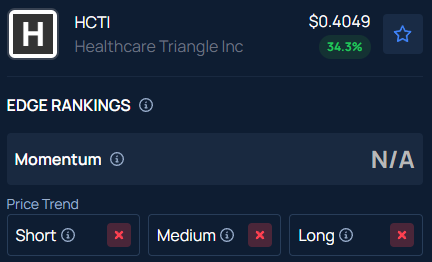

Healthcare Triangle Inc. (NASDAQ:HCTI) shares rose 34.34% in after-hours trading to $0.40 on Wednesday after completing an acquisition.

According to Benzinga Pro, the stock closed regular session at $0.30, up 10.24%.

$50M Deal Closes For Two Spanish Companies

According to a Securities and Exchange Commission filing on Wednesday, Healthcare Triangle’s subsidiary, Teyame AI Holdings Inc., acquired all outstanding equity interests of the Spanish companies Teyamé 360 S.L. and Datono Mediación S.L. from Teyame AI LLC.

The filing stated that the transaction was completed on Thursday.

The total purchase price for the two Spanish companies amounts to up to $50 million.

Equity Component Includes Stock And Earnout

The equity consideration comprises $12 million in restricted common stock and $18 million in convertible preferred stock.

Share quantities are determined by the average volume-weighted average prices for the five trading days immediately prior to the closing date.

The filing also noted that an additional earnout of up to $5 million in preferred stock is payable to key management employees of the acquired companies, structured in two annual $2.5 million tranches tied to gross revenue and earnings before interest, taxes, depreciation, and amortization (EBITDA) targets for the fiscal years ending December 31, 2026, and December 31, 2027.

Trading Metrics, Technical Analysis

Healthcare Triangle has a Relative Strength Index (RSI) of 19.13.

The stock of the California-based healthcare information technology company has a market capitalization of $3.28 million, with a 52-week high of $218.12 and a 52-week low of $0.25.

Over the past 12 months, HCTI stock has seen a staggering decline of 99.85%.

Currently, the stock is trading at about 0.023% of its 52-week range, placing it extremely close to its annual low.

The significant decline and weak positioning near the bottom of the 52-week range indicate substantial pressure, signaling elevated risk and the need for clear signs of recovery before market sentiment can improve.

Benzinga’s Edge Stock Rankings indicate HCTI stock has a negative price trend across all time frames.

Photo Courtesy: yanadhorn on Shutterstock.com

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

Recent Comments