Texas Instruments Incorporated (NASDAQ:TXN) will release earnings results for its fourth quarter, after the closing bell on Tuesday, Jan. 27.

Analysts expect the Dallas, Texas-based company to report quarterly earnings at $1.31 per share, up from $1.30 per share in the year-ago period. The consensus estimate for Texas Instruments’ quarterly revenue is $4.44 billion, versus $4.01 billion a year earlier, according to data from Benzinga Pro.

On Oct. 21, Texas Instruments reported third-quarter revenue of $4.74 billion, beating analyst estimates of $4.65 billion.

Texas Instruments shares gained 1.7% to close at $196.59 on Monday.

Benzinga readers can access the latest analyst ratings on the Analyst Stock Ratings page. Readers can sort by stock ticker, company name, analyst firm, rating change or other variables.

Let’s have a look at how Benzinga’s most-accurate analysts have rated the company in the recent period.

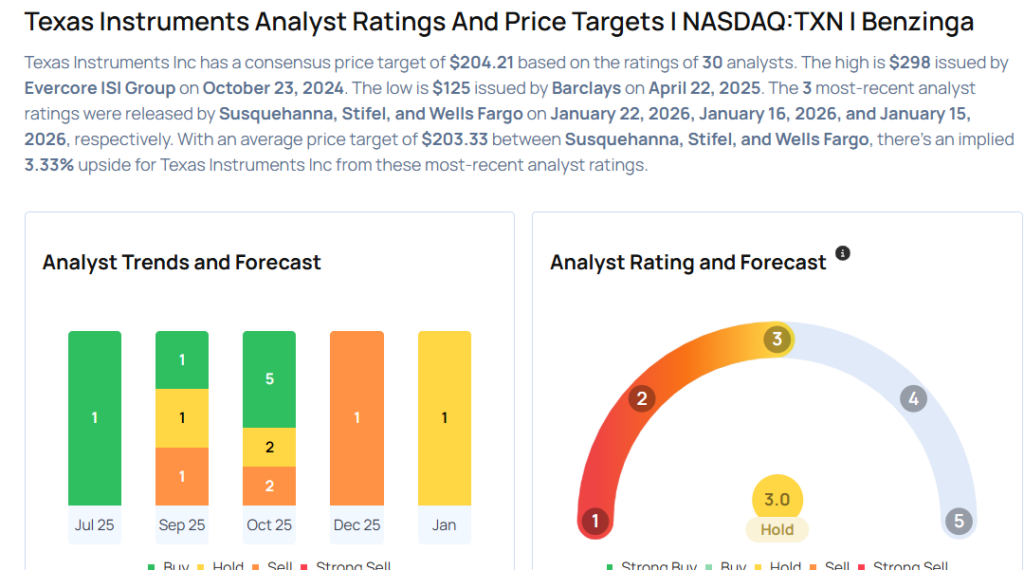

- Susquehanna analyst Christopher Rolland maintained a Positive rating and raised the price target from $200 to $225 on Jan. 22, 2026. This analyst has an accuracy rate of 78%.

- Stifel analyst Tore Svanberg maintained the stock with a Hold rating and raised the price target from $170 to $200 on Jan. 16, 2026. This analyst has an accuracy rate of 82%.

- Wells Fargo analyst Joe Quatrochi maintained the stock with an Equal-Weight rating and raised the price target from $170 to $185 on Jan. 15, 2026. This analyst has an accuracy rate of 55%.

- Truist Securities analyst William Stein maintained the stock with a Hold rating and raised the price target from $175 to $195 on Dec. 19, 2025. This analyst has an accuracy rate of 87%.

- Goldman Sachs analyst James Schneider downgraded the stock from Buy to Sell and cut the price target from $200 to $156 on Dec. 15, 2025. This analyst has an accuracy rate of 65%.

Considering buying RH stock? Here’s what analysts think:

Photo via Shutterstock

Recent Comments