Many investors are understandably concerned about recent geopolitical tensions and their potential impact on global equity markets. Yet, as Warren Buffett famously advises, investors must “hold their nerve when others are panicking” and remain focused on underlying business value rather than short-term noise.

Developments involving Venezuela, Iran, Greenland, and more recently Canada may introduce deviations from baseline forecasts. However, the future is always uncertain, and investors should be careful not to overreact to short-term market fluctuations.

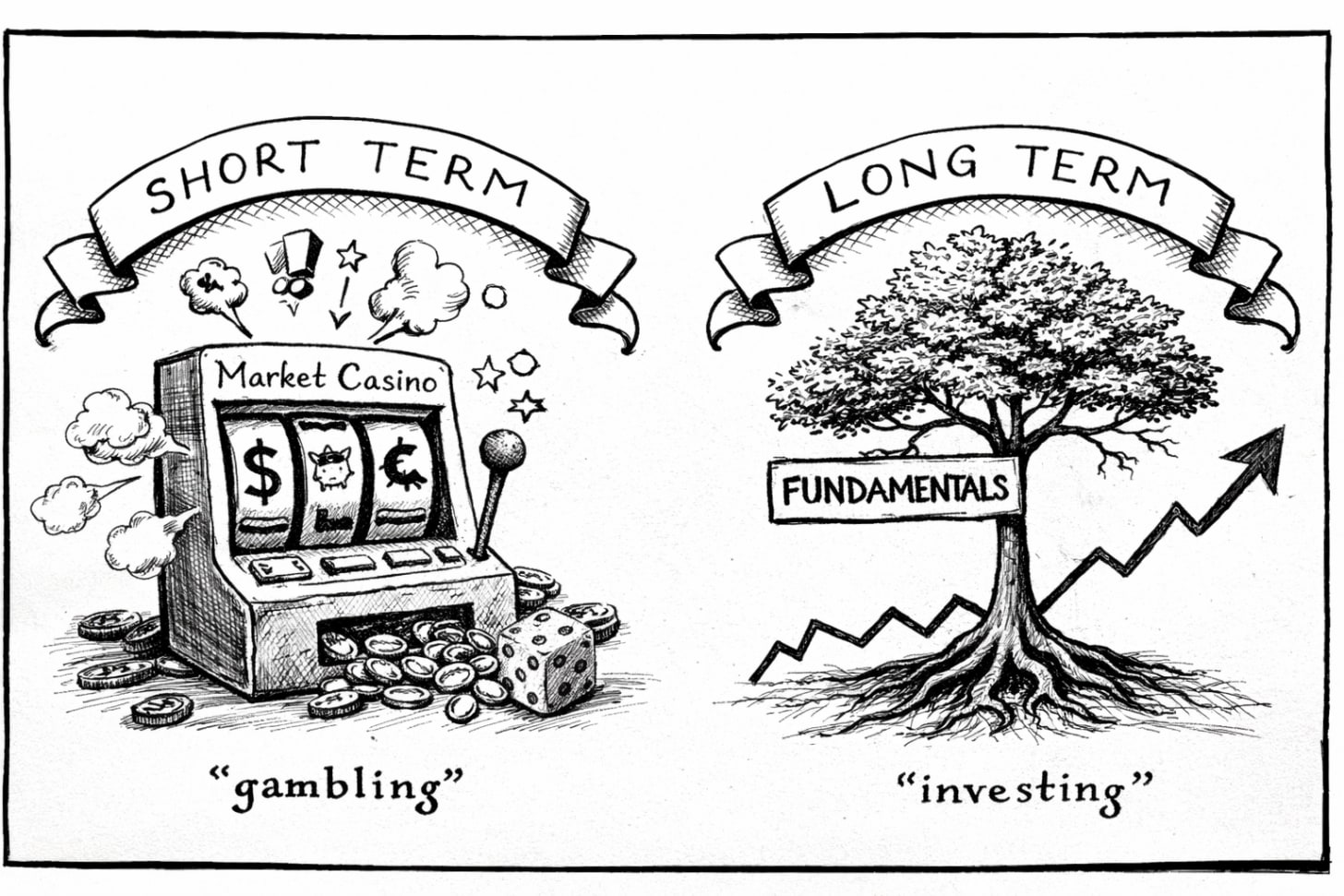

image credit: Author

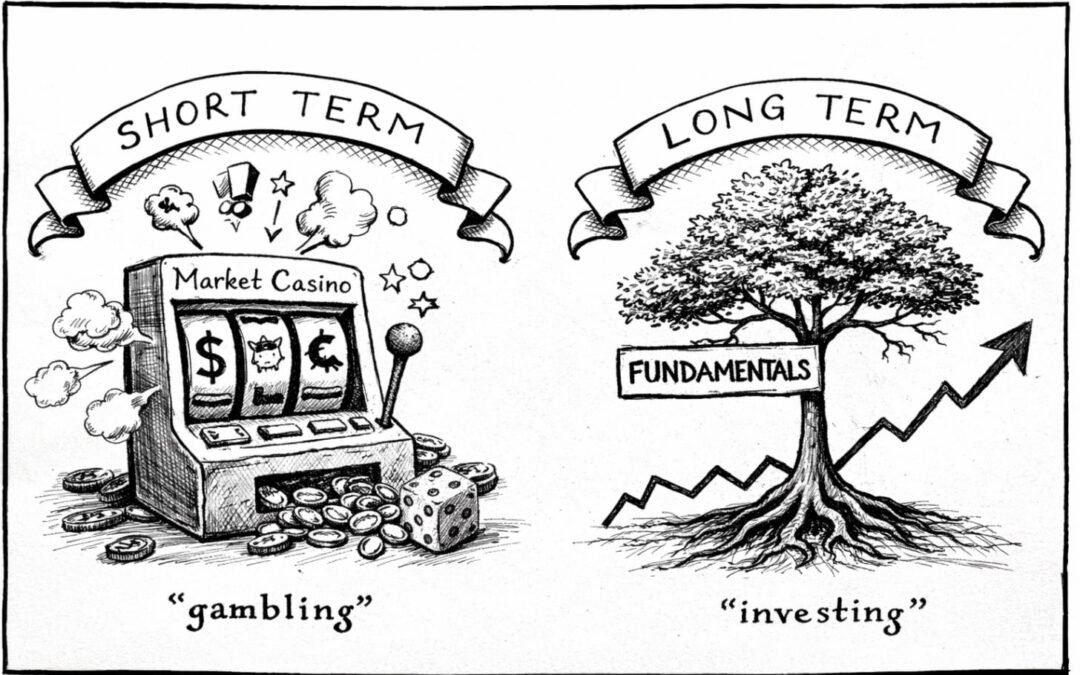

As Benjamin Graham observed, “In the short run, the market is a voting machine, but in the long run, it is a weighing machine.” In other words, markets can behave irrationally in the near term due to headlines and sentiment, but over time they tend to converge toward intrinsic value. With this in mind, recent geopolitical developments should be viewed largely as transient noise, while the focus remains on the fundamental value of businesses.

Putting tariffs into perspective, the situation also appears less severe than some projections suggest. Estimates indicate that even if fully implemented, the total tariff burden would amount to only a fraction of global economic output. While such figures may seem large in isolation, they are relatively modest in the context of the global economy. Consequently, tariffs are unlikely to derail growth to the extent some commentators fear.

It is also worth remembering that similar concerns surfaced last year, prompting predictions of an imminent market downturn. Despite those warnings, the S&P 500 continued to rise and reached new highs. Market timing remains notoriously difficult, and attempting to predict short-term movements is often counterproductive. This does not mean investors should ignore risk—prudence is warranted, particularly given elevated valuations—but focusing excessively on short-term volatility is unlikely to improve long-term outcomes.

image credit: Author

In currency markets, the U.S. dollar experienced renewed volatility following recent tariff developments. Some interpret the dollar’s recent weakness as a sign of declining confidence in the U.S. economy or fiscal position. However, I believe current movements appear consistent with normal currency fluctuations rather than a structural decline. Although the dollar is trading at lower levels, it remains stronger than it was for much of the 2010s. Concerns that the dollar is losing its safe-haven status also seem overstated. As such, current dollar levels—or even modest further weakness—do not appear to signal a broader systemic risk to markets.

As the year continues to progress, I believe what needs to be more closely monitored is a continued heightened equity market – especially in certain sectors – in light of an ever growing bull market coupled with what also appears to be a possible AI bubble. There is no doubt that Artificial Intelligence will likely be one of the greatest breakthroughs of the 21st century. However my concern is that similar to the dot com bubble of 2000, it has wrongly heightened equity prices of what appear to be many inferior businesses.

Therefore I believe that the investors who stand to benefit the most are those who are patient and cautious with their capital allocation and can successfully narrow down the companies who will truly succeed in this next wave of artificial intelligence.

Benzinga Disclaimer: This article is from an unpaid external contributor. It does not represent Benzinga’s reporting and has not been edited for content or accuracy.

Recent Comments