Aswath Damodaran, the ‘Dean of Valuation,’ has issued a stark warning to AI investors that the math simply does not add up. Citing a massive disconnect between upfront infrastructure spending and future earnings, the NYU finance professor revealed he has fully exited his position in Nvidia Corp. (NASDAQ:NVDA) while maintaining his stake in Microsoft Corp. (NASDAQ:MSFT).

The ‘Big Market Delusion’

Damodaran argues that the current AI frenzy exhibits classic signs of a “Big Market Delusion,” a cycle where too many entrepreneurs and investors assume they will capture the majority of a new market.

He estimates that the industry would collectively need to generate “two, three, four trillion in revenues eventually” to justify the capital currently being poured into Large Language Models (LLMs).

“As an investor, you’re going to get eaten alive if you go into that space,” Damodaran warned, noting that venture capitalists and private markets are the ones most at risk of “holding the bag” when the correction arrives.

Why He Sold Nvidia?

While Damodaran acknowledges Nvidia is a “company that delivers,” he believes the stock is now priced for perfection.

He completed his exit from Nvidia at the end of last year, selling his position in a staggered fashion over four years.

“It is richly priced,” Damodaran explained. “You need too much to go right to break even.”

Although Nvidia sits on the safer “architecture” side of the AI boom—meaning it keeps the cash regardless of whether its customers succeed—he argues its current valuation leaves zero margin for error.

The Bull Case for Microsoft

In contrast, Damodaran is holding onto Microsoft. He views the tech giant’s path to justifying its valuation as far more “plausible” than Nvidia’s.

He characterizes the cloud business as a utility essential to modern life, providing a stability that pure-play AI chips lack. “I don’t need as much to happen to justify leaving [Microsoft] in my portfolio,” he noted.

However, he admitted that practical “real-world” issues also played a role; as a California resident, the massive capital gains tax hit from selling a long-term holding like Microsoft incentivizes him to hold.

Nvidia Vs. Microsoft

So far, in 2026, shares of Microsoft have declined by 0.56%. It was down 8.24% over the last six-months and 8.22% over the year. Meanwhile, Nvidia was down 1.26% YTD, up 5.50% in six months, and 57.46% over the year.

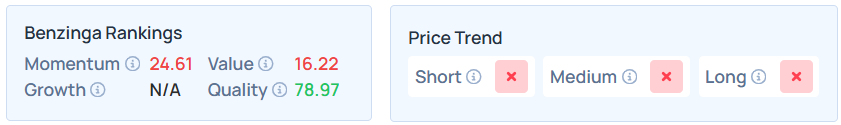

Benzinga’s Edge Stock Rankings indicate that MSFT maintains a weaker price trend over the short, medium, and long terms, with a robust quality ranking.

NVDA, on the other hand, maintains a stronger price trend over the short, medium, and long terms, with a robust growth ranking as per Benzinga’s Edge Stock Rankings.

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

Image via Shutterstock

Recent Comments