U.S. Treasury Secretary Scott Bessent announced on Monday that his department has canceled all contracts with management consulting firm Booz Allen Hamilton Holding Corp. (NYSE:BAH), citing failures to protect sensitive taxpayer data and a past breach that exposed confidential tax information.

Ex-Employee Leaked Trump’s Tax Returns

In a press release, the Treasury Department said that it was cancelling all 31 separate contracts associated with the firm, which amounted to $4.8 million in annual spending and $21 million in total obligations.

Bessent framed the move as part of a broader push by the Trump administration to tighten oversight of government contractors and restore public confidence in federal institutions.

“President Trump has entrusted his cabinet to root out waste, fraud, and abuse,” he said, adding that canceling the contracts was “an essential step to increasing Americans’ trust in government.”

He said the decision was driven by Booz Allen’s handling of sensitive information tied to its work with the Internal Revenue Service, arguing that the firm “failed to implement adequate safeguards to protect sensitive data,” including “the confidential taxpayer information it had access to through its contracts with the Internal Revenue Service.”

This comes amid a high-profile IRS data breach tied to a former Booz Allen employee. Between 2018 and 2020, Charles Littlejohn, then an employee of the firm, stole and leaked confidential tax returns and return information belonging to hundreds of thousands of taxpayers, the Treasury said.

The IRS has determined that the breach affected approximately 406,000 taxpayers. Littlejohn pleaded guilty to felony charges for disclosing confidential tax information without authorization and was sentenced to five years in prison.

The breach also included the tax returns of President Donald Trump and several other wealthy individuals, which were leaked to the media.

Booz Allen’s Stock Drops

Booz Allen’s Treasury contracts account for just a small fraction of its fiscal year 2025 revenue at $12 billion, and its latest order backlogs $38 billion.

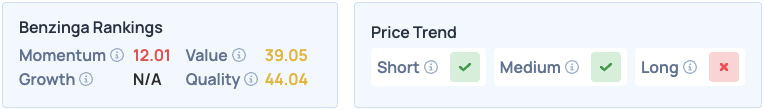

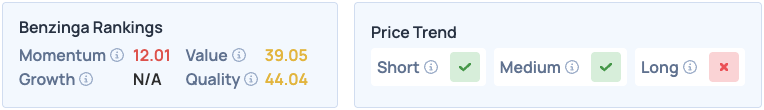

Yet, the company’s shares dropped 8.12% on Monday, closing at $93.93. The stock scores poorly on Momentum, Value and Quality in Benzinga’s Edge Stock Rankings, but has a favorable price trend in the short and medium terms.

Photo Courtesy: Maxim Elramsisy on Shutterstock.com

Recent Comments