Major U.S. benchmarks finished Monday higher, with the Dow Jones Industrial Average climbing 0.6% to 49,412.40, the S&P 500 adding 0.5% to 6,950.23, and the Nasdaq advancing 0.4% to 23,601.35

The anticipation surrounding the earnings of the “Magnificent Seven” stocks, including Microsoft and Meta Platforms, has kept traders on their toes.

These are the top stocks that gained the attention of retail traders and investors throughout the day.

USA Rare Earth Inc. (NASDAQ:USAR)

USA Rare Earth shares surged 7.87% to close at $26.72, reaching an intraday high of $32.07 and a low of $25.80. The stock’s 52-week range is $5.56 to $43.98. The stock rose 1.2% to $27.05 in after-hours trading.

The stock’s rise follows news that the Trump administration plans to invest $1.6 billion in the company, acquiring a 10% stake. This move is part of a strategy to secure essential mineral supplies, with the government receiving 16.1 million shares and warrants for an additional 17.6 million shares at $17.17 each.

GameStop Corp (NYSE:GME)

GameStop’s stock climbed 4.46% to close at $24.01, with a high of $25.01 and a low of $22.95. The stock’s 52-week range is $19.93 to $35.81. The stock rose 2.5% to $24.61 in extended trading.

The rally was fueled by investor Michael Burry’s disclosure of a fresh stake in the company, adding momentum to a rally driven by CEO Ryan Cohen’s insider purchases. Burry’s comments on social media sparked further interest, as he highlighted Cohen’s role in capital deployment.

CoreWeave, Inc. (NASDAQ:CRWV)

CoreWeave shares rose 5.73% to $98.31, hitting an intraday high of $108.65 and a low of $98.05. The stock’s 52-week range is $33.52 to $187.

The increase comes after Nvidia Corporation’s $2 billion investment in the company. The collaboration aims to accelerate AI adoption globally by building AI factories using Nvidia’s technology.

Zoom Communications Inc (NASDAQ:ZM)

Zoom’s stock jumped 11.28% to $95.46, with an intraday high of $95.83 and a low of $86.40. The 52-week range is $64.41 to $95.83. In the after-hours trading, the stock rose 3.2% to $98.53.

The surge is attributed to renewed investor interest in Zoom’s early investment in AI startup Anthropic, which analysts believe could be worth $2 billion to $4 billion. This investment is seen as a “hidden gem” amidst Zoom’s efforts to boost revenue and expand AI offerings.

UnitedHealth Group Incorporated (NYSE:UNH)

UnitedHealth’s stock fell 1.29% to $351.64, with a high of $354.79 and a low of $347.27. The 52-week range is $234.6 to $606.36. The stock fell sharply by 8.6% to $321.30 in extended trading.

UnitedHealth Group shares fell sharply in after-hours trading after reports said the Trump administration planned to propose essentially flat Medicare Advantage rates for 2027, with payments rising just 0.09%, far below expectations.

The decline comes ahead of the company’s earnings release, with analysts revising forecasts. CEO Stephen Hemsley recently addressed lawmakers about rising healthcare costs, urging policy reforms to improve affordability and access.

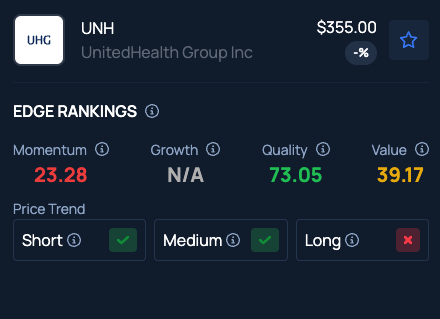

Benzinga Edge Stock Rankings show that UnitedHealth Group stock has a Value in the 39th percentile. It has a Momentum in the 23rd percentile.

Photo Courtesy: santima.studio on Shutterstock.com

Prepare for the day’s trading with top premarket movers and news by Benzinga.

This story was generated using Benzinga Neuro and edited by Shivdeep Dhaliwal

Recent Comments