Webster Financial Corp (NYSE:WBS) reported mixed results for the fourth quarter on Friday.

The company posted quarterly earnings of $1.59 per share which beat the analyst consensus estimate of $1.54 per share. The company reported quarterly sales of $632.853 million which missed the analyst consensus estimate of $643.044 million.

“Webster continued to excel from a fundamental perspective in the fourth quarter, and we enter 2026 from a position of strength,” said John R. Ciulla, chairman and chief executive officer. “It was appropriate that Webster produced record EPS and tangible book value per share in the year of its 90th anniversary.”

Webster Finl shares fell 0.3% to trade at $63.83 on Monday.

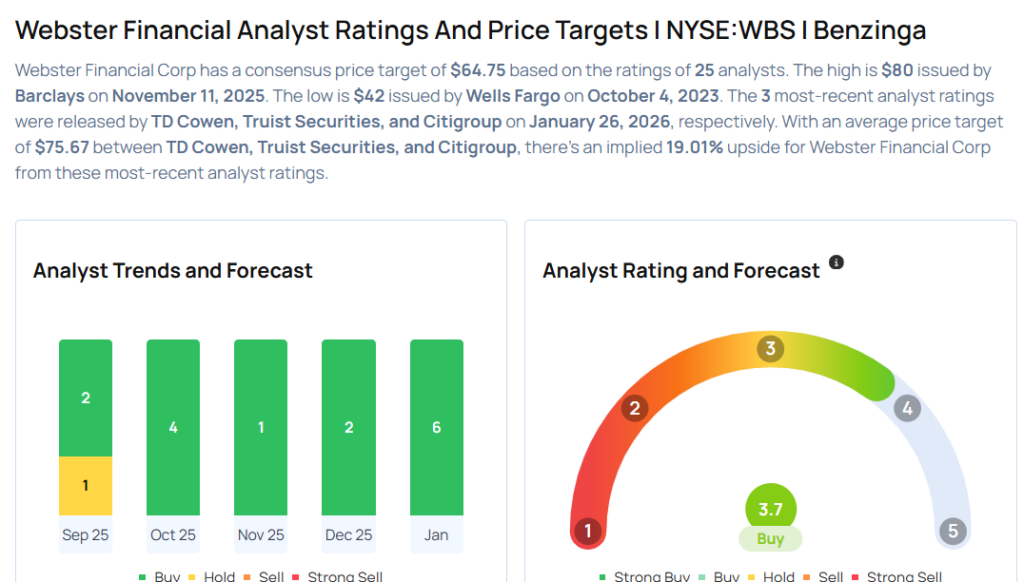

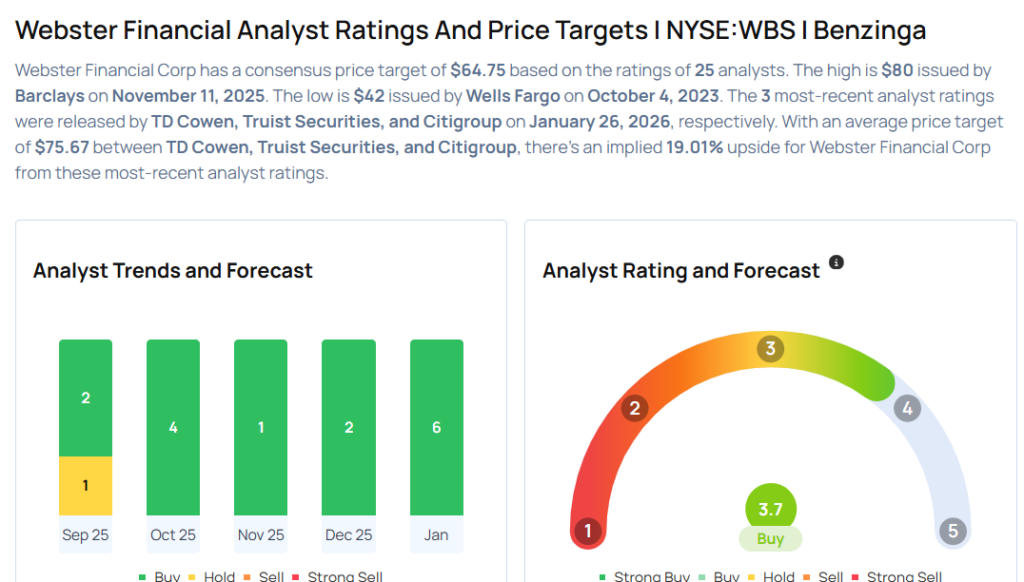

These analysts made changes to their price targets on Webster Finl following earnings announcement.

- Keefe, Bruyette & Woods analyst Christopher Mcgratty maintained Webster Financial with an Outperform rating and raised the price target from $75 to $77.

- Citigroup analyst Ben Gerlinger maintained the stock with a Buy and lowered the price target from $77 to $75.

- Truist Securities analyst David Smith maintained Webster Financial with a Buy and raised the price target from $72 to $73.

- TD Cowen analyst Janet Lee maintained the stock with a Buy and raised the price target from $77 to $79.

Considering buying WBS stock? Here’s what analysts think:

Photo via Shutterstock

Recent Comments