SLB Limited (NYSE:SLB) reported Friday fourth-quarter results that showed sequential improvement as global upstream activity stabilized.

Fourth-quarter revenue totaled $9.745 billion, up 5% from a year earlier and above the $9.547 billion analyst estimate. Diluted GAAP earnings per share were 55 cents, down from 77 cents a year earlier, while diluted EPS, excluding charges and credits, was 78 cents, down from 92 cents a year earlier but ahead of the 74-cent estimate.

“Although 2025 presented a challenging backdrop for the industry — with lower commodity prices, geopolitical uncertainty and an oversupplied oil market — we continued to build resilience across our portfolio by accelerating our strategy. This included a growing emphasis on production and recovery, increased deployment of AI solutions, and the rapid expansion of our Data Center Solutions business,” Chief Executive Officer Olivier Le Peuch said.

SLB shares rose 1.5% to trade at $49.89 on Monday.

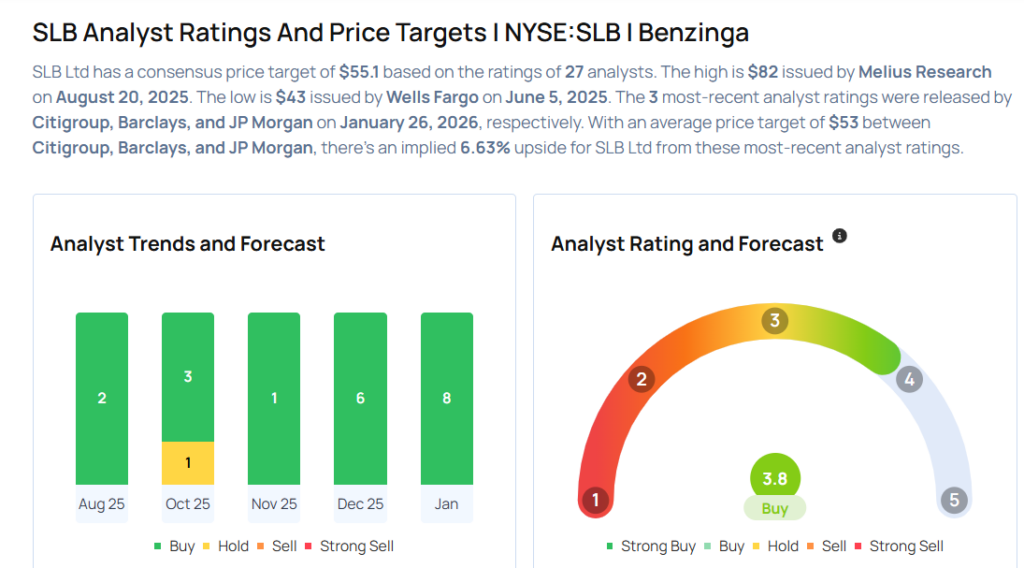

These analysts made changes to their price targets on SLB following earnings announcement.

- B of A Securities analyst Chase Mulvehill maintained SLB with a Buy and raised the price target from $50 to $55.

- BMO Capital analyst Phillip Jungwirth maintained the stock with an Outperform rating and raised the price target from $53 to $55.

- Susquehanna analyst Bascome Majors maintained SLB with a Positive and raised the price target from $52 to $58.

- RBC Capital analyst Keith Mackey maintained the stock with an Outperform rating and raised the price target from $51 to $54.

- JP Morgan analyst Arun Jayaram maintained SLB with an Overweight rating and increased the price target from $43 to $54.

- Barclays analyst David Anderson maintained the stock with an Overweight rating and raised the price target from $47 to $49.

- Citigroup analyst Scott Gruber maintained SLB with a Buy and boosted the price target from $53 to $56.

Considering buying SLB stock? Here’s what analysts think:

Photo via Shutterstock

Recent Comments