In anticipation of Apple Inc.‘s (NASDAQ:AAPL) fiscal first-quarter earnings report, JPMorgan Chase & Co. has raised its price target for the tech giant.

Growth Drivers Beyond AppStore

JPMorgan raised its price target on Apple to $315 from $305, citing confidence in the company’s outlook, and reaffirmed its overweight rating on the stock, reported CNBC on Monday.

The bank’s analyst, Samik Chatterjee, cited better-than-expected iPhone demand and a reduction in operating expenses as potential drivers for an earnings beat. Chatterjee believes that these factors could lead to a 27% upside from the current stock price.

Despite Apple’s recent underperformance, JPMorgan views this as an attractive entry point. The analyst is optimistic about the company’s future, particularly given the upcoming iPhone 17 demand, despite investor worries over rising memory costs, possible pricing sensitivity affecting demand, and slightly weaker growth in App Store services.

Chatterjee expects robust iPhone 17 demand and reduced operating costs to help Apple deliver an earnings and revenue beat this Thursday. He expects Apple’s Services revenue to grow 7% year over year, below the 14% guidance, but noted the company has multiple growth drivers beyond the App Store that could support stronger long-term performance

Apple Set For Record Q1 On iPhone Strength

Earlier in January, Bank of America analyst Wamsi Mohan predicted that Apple could break first-quarter records despite looming memory costs. Mohan expects first-quarter revenue to beat estimates, driven by strong iPhone sales and double-digit growth in Services. He estimates 85 million iPhones were sold in the quarter, raises second-quarter forecasts, and sees continued strong demand for the iPhone 17. iPhone revenue is projected to rise 17% year over year, marking one of the company’s strongest quarters ever.

This news comes on the heels of reports that Apple is rekindling its chip partnership with Intel (NASDAQ:INTC) for its non-Pro iPhone models. This move is seen as a significant shift in Apple’s supply chain strategy and could potentially impact the company’s future performance.

Apple is set to report its first-quarter results on Jan. 29.

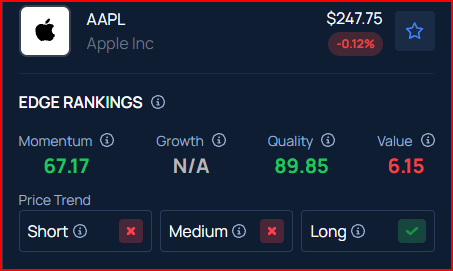

Benzinga’s Edge Rankings place Apple in the 90th percentile for quality and the 67th percentile for momentum, reflecting its average performance. Benzinga’s screener allows you to compare Apple’s performance with its peers.

Price Action: Over the past year, Apple stock climbed 7.91%, as per data from Benzinga Pro. On Friday, the stock edged 0.12% lower to close at $248.04.

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

Photo: hanohiki via Shutterstock

Recent Comments