Lucid Group Inc (NASDAQ:LCID) shares are trading lower on Friday as the company faces a challenging market environment following a recent bullish report. Here’s what investors need to know.

- Lucid Group stock is showing weakness. Why is LCID stock retreating?

Can Lucid’s Robotaxi Vision Become Reality?

Shares of Lucid Group soared this week following a report from Cantor Fitzgerald, which highlighted the Saudi Public Investment Fund’s (PIF) continued commitment to the company. The PIF has invested over $9 billion in Lucid and owns more than 50% of the company, indicating a strong backing that could stabilize its future prospects.

Additionally, Cantor analyst Andres Sheppard noted that the PIF’s commitment is not just transactional but foundational, suggesting that this support may alleviate investor concerns regarding Lucid’s valuation. The report also mentioned plans for the rollout of over 20,000 Lucid Gravity electric SUVs as robotaxis, expected to begin in late 2026 or early 2027.

Why Lucid’s Stock Struggles Signal Caution

Currently, Lucid Group is trading 1.2% above its 20-day simple moving average (SMA) but is 9.3% below its 50-day SMA, 31.1% below its 100-day SMA, and 44.2% below its 200-day SMA. Shares have decreased by 58.75% over the past 12 months and are positioned closer to their 52-week lows than highs, reflecting ongoing struggles in the stock’s performance.

The RSI is at 49.33, indicating neutral territory, while the MACD is above its signal line, suggesting a bullish momentum. The combination of neutral RSI and bullish MACD suggests mixed momentum, indicating that traders should remain cautious while monitoring for potential upward movement.

- Key Resistance: $12.00

- Key Support: $11.00

Earnings Report: A Turning Point Ahead?

Investors are looking ahead to the next earnings report on Feb. 24.

- EPS Estimate: $-2.57 (Down from $-2.20 YoY)

- Revenue Estimate: $468.45 million (Up from $234.47 million YoY)

Analyst Consensus & Recent Actions: The stock has an average price target of $25.70. Recent analyst moves include:

- Morgan Stanley: Downgraded to Underweight (Lowers Target to $10.00) (Dec. 8, 2025)

- Stifel: Hold (Lowers Target to $17.00) (Nov. 17, 2025)

- Cantor Fitzgerald: Neutral (Lowers Target to $21.00) (Nov. 6, 2025)

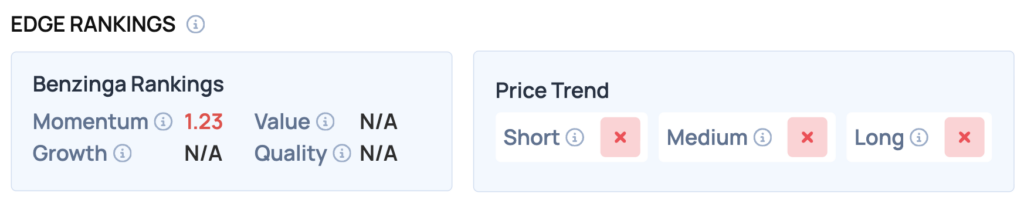

Benzinga Edge Rankings

Below is the Benzinga Edge scorecard for Lucid Group, highlighting its strengths and weaknesses compared to the broader market:

- Momentum: Bearish (Score: 1.23) — The stock is underperforming relative to the market.

The Verdict: Lucid Group’s Benzinga Edge signal reveals a challenging position as the stock struggles with momentum. While the recent backing from the PIF provides some stability, the low momentum score indicates that investors should proceed with caution.

Top ETF Exposure

- SPDR S&P Kensho Smart Mobility ETF (NYSE:HAIL): 2.02% Weight

- GraniteShares 2x Long LCID Daily ETF (NASDAQ:LCDL): 200.01% Weight

Significance: Because LCID carries such a heavy weight in these funds, any significant inflows or outflows for these ETFs will likely force automatic buying or selling of the stock.

LCID Shares Fall Friday

LCID Price Action: Lucid Group shares were down 1.39% at $11.32 at the time of publication on Friday, according to Benzinga Pro data.

Image: Shutterstock

Recent Comments