AST SpaceMobile Inc (NASDAQ:ASTS) shares are trading marginally lower Friday, near their all-time high, following the company’s announcement about its BlueBird 7 mission, which is set to launch in late February. Here’s what investors need to know.

- AST SpaceMobile stock is showing upward bias. Where are ASTS shares going?

How BlueBird 7 Is Redefining Satellite Communications

The BlueBird 7 mission, which is identical to its predecessor BlueBird 6, will carry the largest commercial communications array in low Earth orbit, supporting peak data speeds of up to 120 Mbps.

This mission marks the first launch of the New Glenn rocket, capable of carrying multiple BlueBird satellites per flight, as the company plans a multi-launch campaign throughout 2026.

The satellite rollout is backed by over 3,800 patents and aims to deploy 45-60 satellites by the end of the year, enhancing AST SpaceMobile’s capabilities in space-based voice, data, and streaming services. The company also secured a position on the U.S. Missile Defense Agency’s SHIELD program, which could lead to future task orders.

Can AST SpaceMobile Sustain This Momentum?

AST SpaceMobile is currently trading 26.7% above its 20-day simple moving average (SMA) and 67.8% above its 100-day SMA, indicating strong short-term and longer-term momentum. Shares have increased 486.74% over the past 12 months and are currently positioned closer to their 52-week highs than lows.

The RSI is at 65.41, which is considered neutral territory, while the MACD is above its signal line, indicating bullish momentum. The combination of neutral RSI and bullish MACD suggests mixed momentum, indicating potential for further gains.

- Key Resistance: $120.93

Analysts Are Divided Ahead Of Earnings

Investors are looking ahead to the next earnings report on Mar. 2.

- EPS Estimate: Loss of 19 cents (Down from Loss of 18 cents YoY)

- Revenue Estimate: $39.03 million (Up from $1.92 million YoY)

Analyst Consensus & Recent Actions: The stock carries a Hold Rating with an average price target of $61.08. Recent analyst moves include:

- B. Riley Securities: Downgraded to Neutral (Raises Target to $105.00) (Jan. 13)

- Scotiabank: Downgraded to Sector Underperform (Target $45.60) (Jan. 7)

- Scotiabank: Upgraded to Sector Perform (Target $45.60) (Nov. 25, 2025)

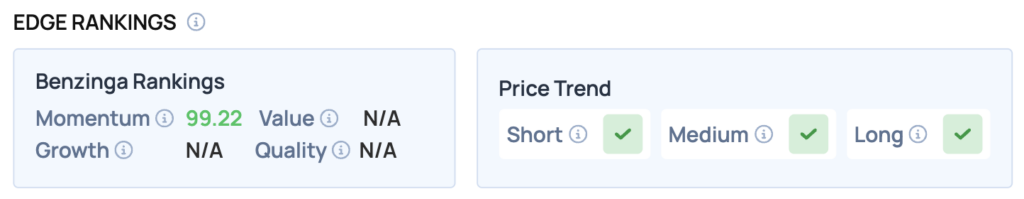

Benzinga Edge Rankings

Below is the Benzinga Edge scorecard for AST SpaceMobile, highlighting its strengths and weaknesses compared to the broader market:

- Momentum: Bullish (Score: 99.22) — Stock is outperforming the broader market.

The Verdict: AST SpaceMobile’s Benzinga Edge signal reveals a strong momentum setup, indicating that the stock is currently outperforming its peers. Investors should remain cautious as they monitor for potential volatility ahead of the earnings report.

Top ETF Exposure

- First Trust Indxx Aerospace & Defense ETF (NYSE:MISL): 4.27% Weight

- Defiance Connective Technologies ETF (NASDAQ:SIXG): 3.48% Weight

- Tradr 2X Long ASTS Daily ETF (NASDAQ:ASTX): 120.88% Weight

Significance: Because ASTS carries such a heavy weight in these funds, any significant inflows or outflows for these ETFs will likely force automatic buying or selling of the stock.

ASTS Shares Trade Flat Friday

ASTS Price Action: AST SpaceMobile shares were down 2.64% at $113.28 at the time of publication on Friday. The stock is trading near its 52-week high of $120.93, according to Benzinga Pro data.

Image: Shutterstock

Recent Comments