As of Jan. 23, 2026, two stocks in the materials sector could be flashing a real warning to investors who value momentum as a key criteria in their trading decisions.

The RSI is a momentum indicator, which compares a stock’s strength on days when prices go up to its strength on days when prices go down. When compared to a stock’s price action, it can give traders a better sense of how a stock may perform in the short term. An asset is typically considered overbought when the RSI is above 70, according to Benzinga Pro.

Here’s the latest list of major overbought players in this sector.

Namib Minerals (NASDAQ:NAMM)

- On Nov. 24, Namib Minerals issued a business update on its strategic growth initiatives. “As a publicly traded company, we are committed to transparent communication as we advance our growth strategy,” said Ibrahima Sory Tall, Chief Executive Officer of Namib Minerals. “We are focused on building Namib Minerals into a multi-asset, mid-tier producer through operational optimization at How Mine and the disciplined restart of our Mazowe and Redwing mines. Our engagement of WSP for comprehensive feasibility studies, combined with the commencement of enabling works at Redwing and capacity expansion initiatives at How Mine, demonstrates tangible progress toward our vision. We look forward to updating the investment community on our strategic roadmap and near-term milestones.” The company’s stock gained around 334% over the past five days and has a 52-week high of $55.00.

- RSI Value: 92.4

- NAMM Price Action: Shares of Namib Minerals gained 83.6% to close at $4.15 on Thursday.

Hycroft Mining Holding Corporation (NASDAQ:HYMC)

- On Oct. 28, Hycroft Mining Holding posted a narrower-than-expected quarterly loss. The company’s stock gained around 90% over the past month and has a 52-week high of $47.18.

- RSI Value: 81.7

- HYMC Price Action: Shares of Hycroft Mining rose 18% to close at $46.69 on Thursday.

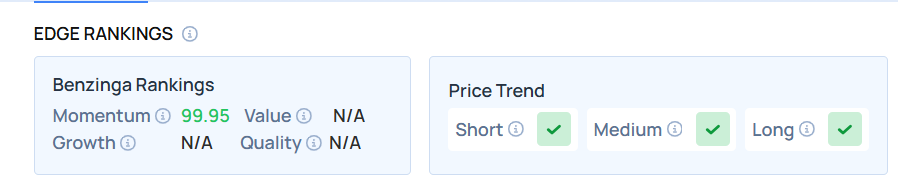

- Edge Stock Ratings: 99.95 Momentum score.

Learn more about BZ Edge Rankings—click to see scores for other stocks in the sector and see how they compare.

Photo via Shutterstock

Recent Comments