Booz Allen Hamilton Holding Corporation (NYSE:BAH) will release earnings for its third quarter before the opening bell on Friday, Jan. 23.

Analysts expect the McLean, Virginia-based company to report fourth-quarter earnings of $1.27 per share. That’s down from $1.55 per share in the year-ago period. The consensus estimate for Booz Allen Hamilton’s quarterly revenue is $2.73 billion (it reported $2.92 billion last year), according to Benzinga Pro.

On Jan. 12, Booz Allen disclosed a partnership with Andreessen Horowitz to accelerate and scale advanced technology for Governments.

Shares of Booz Allen Hamilton rose 0.2% to close at $95.76 on Thursday.

Benzinga readers can access the latest analyst ratings on the Analyst Stock Ratings page. Readers can sort by stock ticker, company name, analyst firm, rating change or other variables.

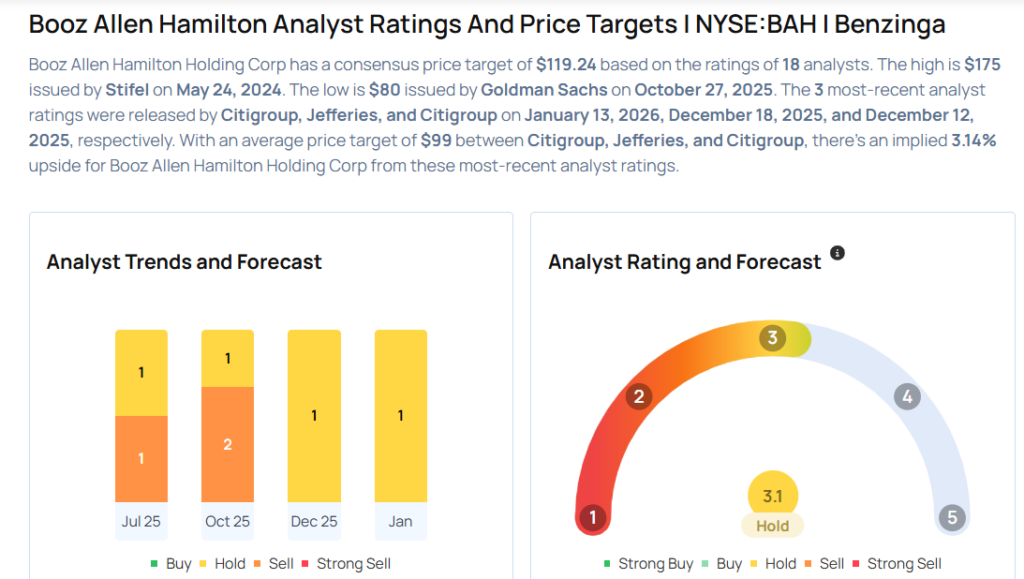

Let’s have a look at how Benzinga’s most-accurate analysts have rated the company in the recent period.

- Citigroup analyst John Godyn maintained a Neutral rating and raised the price target from $93 to $109 on Jan. 13, 2026. This analyst has an accuracy rate of 66%.

- Jefferies analyst Howard Rubel maintained a Hold rating and cut the price target from $100 to $95 on Dec. 18, 2025. This analyst has an accuracy rate of 80%.

- UBS analyst Gavin Parsons maintained a Neutral rating and cut the price target from $115 to $93 on Oct. 27, 2025. This analyst has an accuracy rate of 75%.

- Goldman Sachs analyst Noah Poponak maintained a Sell rating and slashed the price target from $93 to $80 on Oct. 27, 2025. This analyst has an accuracy rate of 69%.

- JP Morgan analyst Seth Seifman maintained an Underweight rating and cut the price target from $122 to $90 on Oct. 27, 2025. This analyst has an accuracy rate of 86%

Considering buying BAH stock? Here’s what analysts think:

Photo via Shutterstock

Recent Comments