Eric Trump said major U.S. banks are actively resisting cryptocurrency legislation because it threatens what he described as a long-standing monopoly over the financial system.

‘Big Banks’ Trying Everything To Stop Crypto Legislation

The son of President Donald Trump and the co-founder of American Bitcoin Corp. (NASDAQ:ABTC) and World Liberty Financial (CRYPTO: WLFI) argued that legacy banks benefit from inefficiencies built into traditional finance and have little incentive to support faster, technology-driven alternatives, while speaking to Fox Business from Davos on Thursday.

“The big banks have been an absolute monopoly of our financial system for years,” he said, while pointing to inefficiencies in the current system. “Why can’t you send a wire transfer past 5 o’clock on a Friday afternoon?” he asked.

According to Trump, these delays and inefficiencies are intentional, “because the big banks would love to take hundreds of billions of dollars and have it sit there and clip interest off of it over the course of a long weekend,” he said.

Trump said modern digital alternatives make it possible to move money nearly instantly, but the banks oppose these changes because they undermine the current system. “They want to be able to use their money. They want to be able to arbitrage your money,” he said.

Such incentives, he said, are prompting the “big banks” to do everything they can to stop the “crypto legislation” for “obvious” reasons. “The entire financial system is changing.”

Crypto Market Structure Bill Delayed

This comes as the Senate Banking Committee has pushed the crypto market structure bill further down the line to late February or March, after Coinbase Global Inc. (NASDAQ:COIN) withdrew its support due to disagreements with the banking industry.

In September 2025, Trump had predicted an “unbelievable” fourth-quarter rally in cryptocurrency markets amid rising M2 money supply and quantitative easing by the Federal Reserve.

This, however, has failed to materialize, with Bitcoin (CRYPTO: BTC) prices dropping 19.8% since he made this prediction. The upcoming market structure bill is expected to turn the tide for the market, with investors and analysts viewing it as a much-needed catalyst.

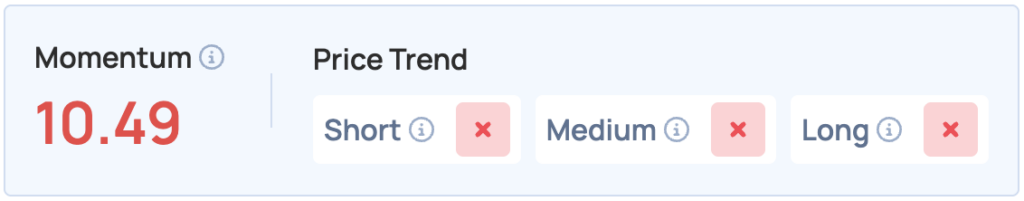

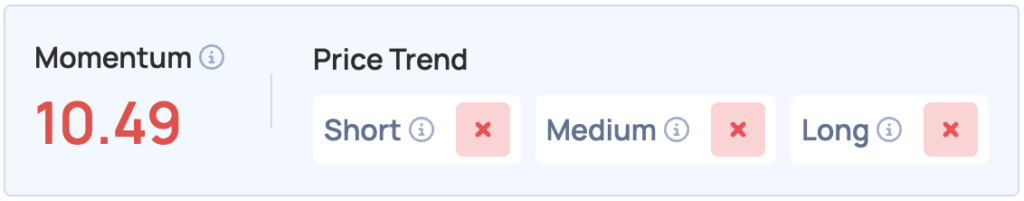

The iShares Bitcoin Trust ETF (NASDAQ:IBIT), which tracks the prices of Bitcoin, was down 0.86% on Thursday, closing at $50.67 per share and is up 0.39% overnight. The fund has a poor Momentum score in Benzinga’s Edge Stock Rankings, with an unfavorable price trend in the short, medium and long terms.

Photo Courtesy: Maxim Elramsisy On Shutterstock.com

Recent Comments