As of Jan. 22, 2026, two stocks in the information technology sector could be flashing a real warning to investors who value momentum as a key criteria in their trading decisions.

The RSI is a momentum indicator, which compares a stock’s strength on days when prices go up to its strength on days when prices go down. When compared to a stock’s price action, it can give traders a better sense of how a stock may perform in the short term. An asset is typically considered overbought when the RSI is above 70, according to Benzinga Pro.

Here’s the latest list of major overbought players in this sector.

RF Industries Ltd (NASDAQ:RFIL)

- On Jan. 14, RF Industries reported better-than-expected fourth-quarter financial results. “I am extremely pleased with our team’s performance in the fourth quarter. Net sales were $22.7 million, an increase of 23% year-over-year. In the past several quarters, we have discussed how our strategic transformation continued to deliver operating leverage and it really showed up in Q4. Our quarterly results were diverse by customer, product, and market segment with solid contributions across our broad portfolio,” said Robert Dawson, Chief Executive Officer of RF Industries. The company’s stock gained around 82% over the past five days and has a 52-week high of $12.12.

- RSI Value: 90.9

- RFIL Price Action: Shares of RF Industries gained 10% to close at $11.99 on Wednesday.

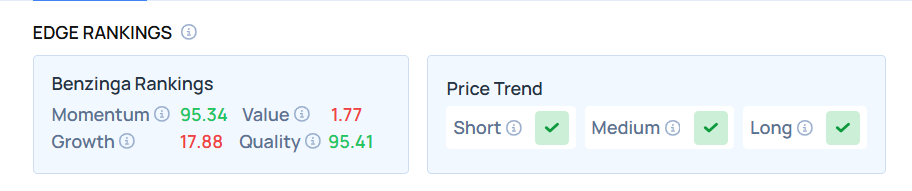

- Edge Stock Ratings: 95.34 Momentum score with Value at 1.77.

Ultra Clean Holdings Inc (NASDAQ:UCTT)

- On Jan. 20, Needham analyst Charles Shi maintained Ultra Clean with a Buy and raised the price target from $35 to $50. The company’s stock gained around 82% over the past month and has a 52-week high of $47.22.

- RSI Value: 89.8

- UCTT Price Action: Shares of Ultra Clean rose 6.6% to close at $47.20 on Wednesday.

Curious about other BZ Edge Rankings? Click here to discover how similar stocks measure up.

Photo via Shutterstock

Recent Comments