U.S. stock futures rose Wednesday night after President Donald Trump signaled a retreat from planned tariffs on the European Union, following what he described as a “very productive” meeting with NATO Secretary General Mark Rutte, marking a resurgence of the “TACO Trade.”

The S&P 500 Futures are up 0.30%, or 21 points, trading at 6,931.00, followed by Nasdaq Futures at 25,579.00, up 0.43%, or 108 points and finally Dow Futures, trading at 49,353.00, up 88 points, or 0.18%, on late Wednesday evening.

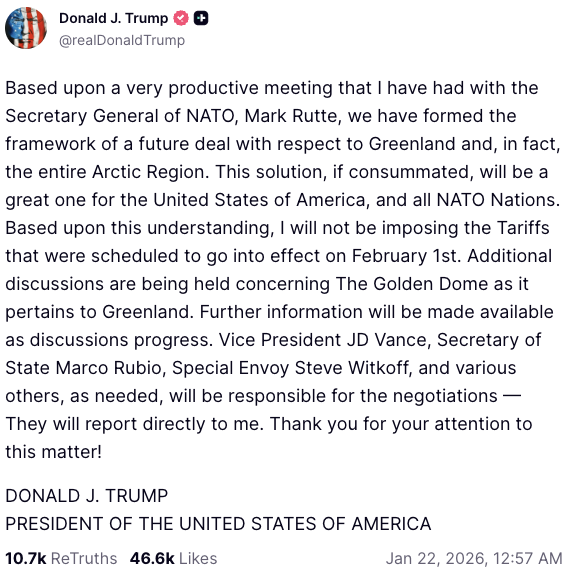

This comes after Trump announced in a Truth Social post on Wednesday that he will no longer impose the planned 10% tariffs on the bloc, after arriving at a “framework of a future deal” on Greenland, following talks with Rutte at the World Economic Forum in Davos.

Asian markets are surging on the news, with Japan’s Nikkei 225 up 1.20%, or 635 points, trading at 53,409.16, with stocks having exposure to European markets leading the rally.

Japan’s exports rose 5.1% year over year in December, extending its growth streak to a fourth straight month, according to Trade Statistics of Japan. Shipments to the U.S. fell 11.1% from a year earlier, but the decline was offset by stronger demand from other markets and a weaker yen.

The spot prices of leading precious metals are retreating for the day, with Gold trading at $4,806 per ounce, down 0.52% and Silver at $92.355, down 0.81%.

The U.S. Dollar Index (DXY) is flat, trading at 98.787, down just 0.01% for the day, but up 0.86% over the past month despite growing concerns surrounding the Federal Reserve’s independence.

Investors on Thursday will be looking forward to the earnings releases of Procter & Gamble Co. (NYSE:PG), General Electric Co. (NYSE:GE), Intel Corp. (NASDAQ: INTC) and Capital One Financial Corp. (NYSE:COF). Markets will also be watching the GDP report, Initial Jobless Claims and the Personal Consumption Expenditure reports during the day.

Photo Courtesy: Trismegist san on Shutterstock.com

Recent Comments