CoreWeave Inc (NASDAQ:CRWV) shares are trading lower amid overall market volatility this week after President Donald Trump posted on social media that, starting Feb. 1, Denmark, Norway, Sweden, France, Germany, the UK, the Netherlands and Finland will be charged a 10% tariff on all goods sent to the United States.

President Trump has also recently escalated rhetoric about making Greenland a U.S. territory. Here’s what investors need to know.

- CoreWeave stock is showing notable weakness. Why is CRWV stock falling?

What Investors Need To Know Amid Geopolitical Tensions

CoreWeave is pouring billions into AI data centers and GPU clusters across tariff-targeted countries like Norway, Sweden and the UK, so Trump’s threat of 10% to 25% import duties immediately makes investors worry that equipment, construction and cross-border cloud contracts tied to those sites will become more expensive or politically risky.

Because CoreWeave already relies on heavy borrowing to fund this expansion, even a small hit to margins or European demand could pressure its cash flow and delay its path to profitability.

Trump’s escalating rhetoric about taking Greenland further heightens geopolitical tension in the Nordic and Arctic region where CoreWeave is building huge hydropower-backed campuses, so traders used the headlines this week as a reason to dump a highly leveraged, Europe-exposed AI infrastructure name during a broader risk-off selloff.

Dismissing Circular Financing Claims

In a recent podcast, CEO Michael Intrator dismissed allegations of circular financing with Nvidia, labeling such claims as “ridiculous” and mathematically unsound. He emphasized that Nvidia’s $300 million investment is minimal compared to CoreWeave’s total capital of over $25 billion, which supports a valuation of $42 billion.

Intrator further explained that the company’s use of debt is managed through special purpose vehicles, ensuring that revenue from contracts with major clients like Microsoft and Meta Platforms is ring-fenced to cover operating expenses and lenders first. This structure is designed to mitigate risk and is comparable to traditional infrastructure financing methods.

Short-Term Strength Versus Long-Term Weakness

CoreWeave is currently trading 27.1% above its 20-day simple moving average (SMA) but is 1.3% below its 100-day SMA, indicating some short-term strength while showing longer-term weakness. Shares have increased by 124.90% over the past 12 months and are currently positioned closer to their 52-week highs than lows.

The RSI is at 59.22, which is considered neutral territory, suggesting that the stock is neither overbought nor oversold. Meanwhile, MACD is above its signal line, indicating bullish momentum.

The combination of neutral RSI closer to overbought territory and bullish MACD suggests mixed momentum.

- Key Resistance: $91.00

- Key Support: $85.00

Quarterly Earnings Come Into Focus

Investors are looking ahead to the next earnings report on Feb.14.

- EPS Estimate: Loss of 65 cents

- Revenue Estimate: $1.54 billion

Analyst Consensus & Recent Actions: The stock carries a Buy Rating with an average price target of $125.52. Recent analyst moves include:

- Barclays: Equal-Weight (Lowered Target to $90.00) (Jan. 12)

- Wells Fargo: Overweight (Lowered Target to $125.00) (Jan. 8)

- Truist Securities: Initiated with Hold (Target $84.00) (Jan. 6)

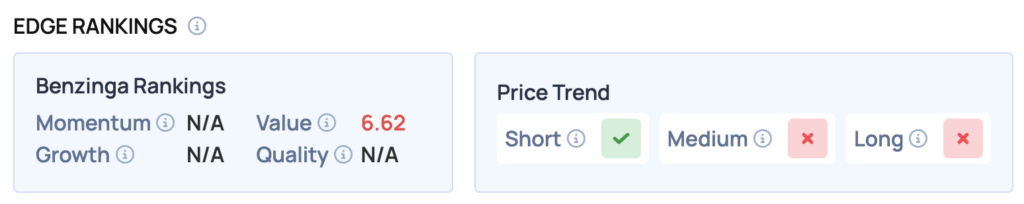

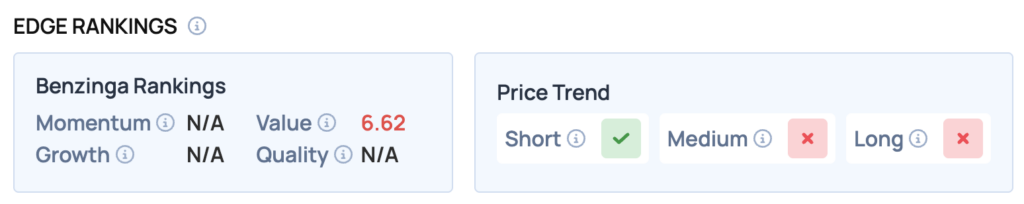

Benzinga Edge Rankings

Below is the Benzinga Edge scorecard for CoreWeave, highlighting its strengths and weaknesses compared to the broader market:

- Value: Risk (Score: 6.62/100) — Trading at a steep premium relative to peers.

Top ETF Exposure

- Tradr 2X Long CRWV Daily ETF (NASDAQ:CWVX)

- iShares US Digital Infrastructure and Real Estate ETF (NYSE:IDGT): 4.65% Weight

CRWV Shares Slide Wednesday

CRWV Price Action: CoreWeave shares were down 6.77% at $88.77 at the time of publication on Wednesday, according to Benzinga Pro data.

Image: Shutterstock

Recent Comments