D.R. Horton, Inc. (NYSE:DHI) reported upbeat earnings for its fiscal 2026 first quarter on Tuesday.

Net income attributable to D.R. Horton totaled $594.8 million, or $2.03 per diluted share, for the three months ended Dec. 31, 2025, compared with $844.9 million, or $2.61 per diluted share, in the prior-year quarter. Earnings per share exceeded the $1.95 analyst estimate.

Revenue was $6.887 billion, down from $7.613 billion a year earlier. Sales also exceeded expectations, surpassing the $6.603 billion consensus estimate.

David Auld, Executive Chairman, said, “The D.R. Horton team delivered a solid first quarter. We exceeded the high end of our closings and revenue guidance and leveraged our strong financial position and cash flow generation to return $801.2 million to shareholders through share repurchases and dividends during the quarter.”

D.R. Horton shares gained 3.1% to trade $157.93 on Wednesday.

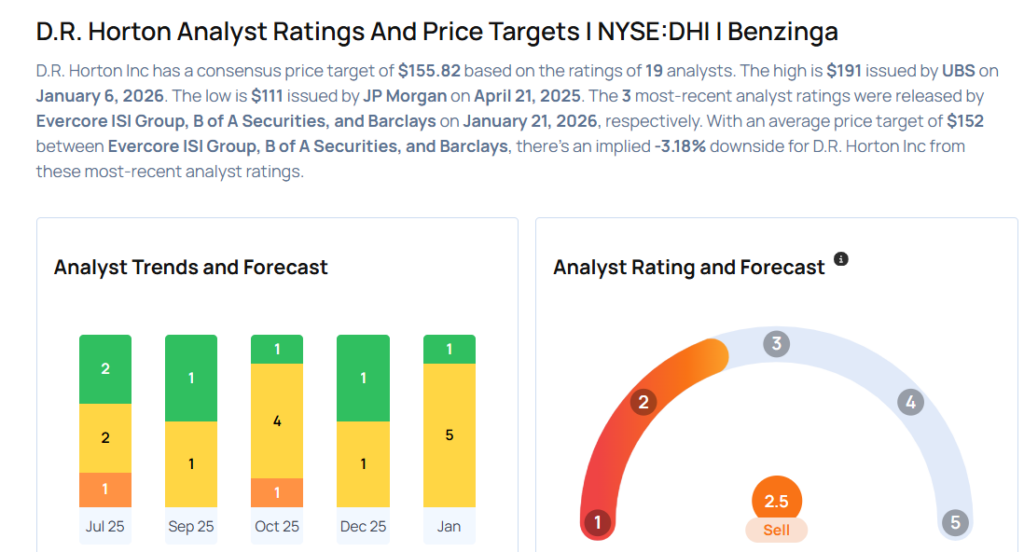

These analysts made changes to their price targets on D.R. Horton following earnings announcement.

- Barclays analyst Matthew Bouley maintained D.R. Horton with an Equal-Weight rating and lowered the price target from $132 to $129.

- B of A Securities analyst Rafe Jadrosich maintained the stock with a Neutral and cut the price target from $162 to $158.

- Evercore ISI Group analyst Stephen Kim maintained D.R. Horton with an In-Line rating and raised the price target from $167 to $169.

Considering buying DHI stock? Here’s what analysts think:

Photo via Shutterstock

Recent Comments