U.S. Bancorp (NYSE:USB) reported upbeat fourth-quarter 2025 results on Tuesday.

The company reported fourth-quarter adjusted earnings per share of $1.26, beating the analyst consensus estimate of $1.19. Quarterly sales of $7.337 billion outpaced the Street view of $7.308 billion.

“Record consumer deposits this quarter and effective balance sheet remixing contributed to net interest income growth and margin expansion. Fee income exceeded our mid-single-digit growth target and was supported by broad strength across our diversified fee businesses,” said CEO Gunjan Kedia.

U.S. Bancorp forecast fiscal 2026 revenue of $29.85 billion to $30.42 billion, compared with Wall Street expectations of $30.04 billion.

U.S. Bancorp shares gained 1.5% to trade $55.16 on Wednesday.

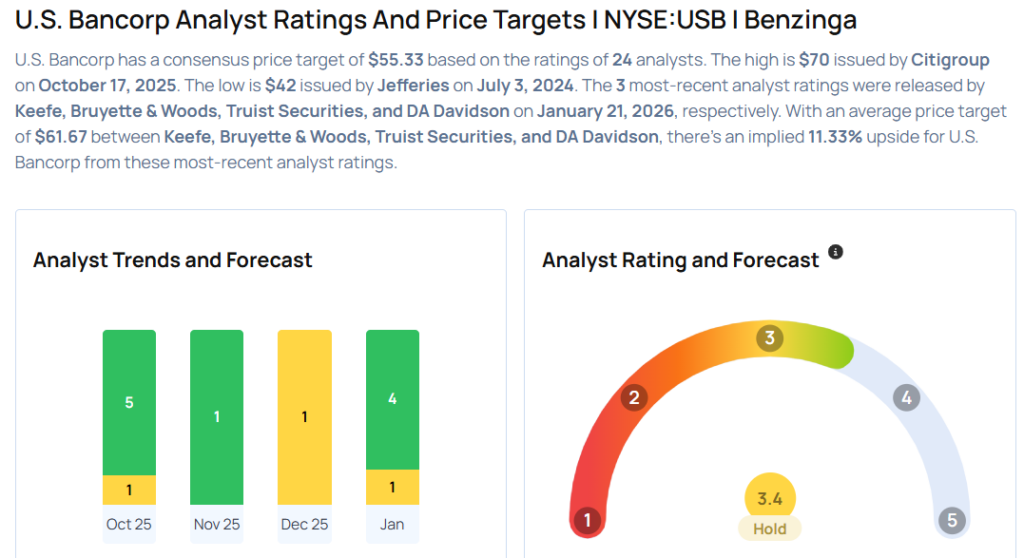

These analysts made changes to their price targets on U.S. Bancorp following earnings announcement.

- RBC Capital analyst Gerard Cassidy maintained U.S. Bancorp with an Outperform rating and raised the price target from $57 to $59.

- DA Davidson analyst Peter Winter maintained the stock with a Buy and raised the price target from $63 to $65.

- Truist Securities analyst John McDonald maintained U.S. Bancorp with a Hold and boosted the price target from $58 to $61.

- Keefe, Bruyette & Woods analyst David Konrad maintained the stock with a Market Perform and raised the price target from $58 to $59.

Considering buying USB stock? Here’s what analysts think:

Photo via Shutterstock

Recent Comments