Fifth Third Bancorp (NASDAQ:FITB) reported better-than-expected earnings for the fourth quarter on Tuesday.

The company posted quarterly earnings of $1.08 per share which beat the analyst consensus estimate of 99 cents per share. The company reported quarterly sales of $2.344 billion which missed the analyst consensus estimate of $2.392 billion.

Tim Spence, Fifth Third Chairman, CEO and President said, “Fifth Third delivered strong operating results in the fourth quarter and for the full year. In 2025, we produced record NII, generated profitable relationship growth and diligently managed our expenses, generating 230 bps of positive operating leverage. Our strong profitability allowed us to return $1.6 billion of capital to our shareholders while maintaining strong capital ratios and increasing tangible book value per share 21% compared to last year.”

Fifth Third Bancorp shares gained 3.1% to trade $51.67 on Wednesday.

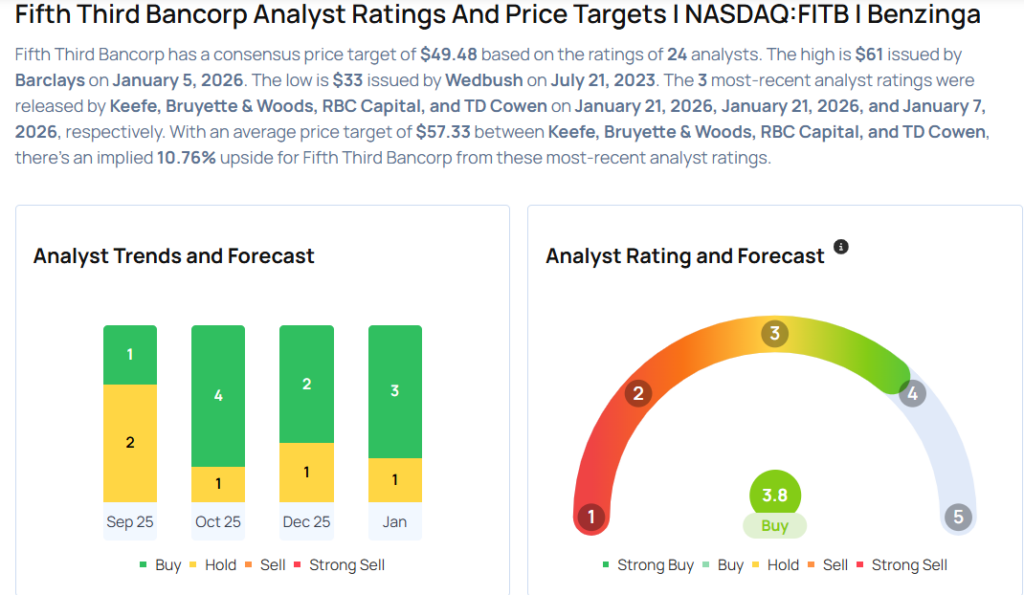

These analysts made changes to their price targets on Fifth Third Bancorp following earnings announcement.

- RBC Capital analyst Gerard Cassidy maintained Fifth Third Bancorp with an Outperform rating and raised the price target from $52 to $57.

- Keefe, Bruyette & Woods analyst David Konrad maintained the stock with a Market Perform and raised the price target from $53 to $55.

Considering buying FITB stock? Here’s what analysts think:

Photo via Shutterstock

Recent Comments