Lucid Group Inc (NASDAQ:LCID) shares traded sharply higher Wednesday afternoon after the luxury EV maker expanded a key manufacturing partnership in Saudi Arabia, bolstering confidence in its long-term growth outlook. Here’s what investors need to know.

- Lucid Group stock is surging to new heights today. What’s behind LCID gains?

Rockwell Deal Targets Faster, Smarter Production For LCID Stock

Rockwell Automation announced a deeper collaboration with Lucid to power the automaker’s growing plant in King Abdullah Economic City, Saudi Arabia’s first vehicle manufacturing site.

Lucid will roll out Rockwell’s FactoryTalk manufacturing execution system across general assembly, paint, stamping, body and powertrain operations, giving the company real-time visibility and control over its production lines and future midsize vehicle programs.

The software is designed to boost efficiency, quality and scalability while integrating Lucid’s Saudi output with global supply chains and local regulatory standards. Rockwell will also deliver in-country training programs to build a skilled EV workforce, aligning with Saudi Arabia’s Vision 2030 industrial strategy.

Why The News Sent LCID Stock Higher

For investors, the announcement signals that Lucid is moving beyond a single U.S. factory toward a multi-plant, global production footprint, a key requirement to spread fixed costs and eventually reach profitability.

Management highlighted that Rockwell has supported Lucid from its Arizona facility to its Saudi expansion, suggesting operational continuity as volumes ramp.

The Rockwell news follows a recent deal for Trimble positioning technology in Lucid’s upcoming Gravity SUV, underscoring a steady drumbeat of product and technology catalysts.

The moves likely reinforce expectations for higher future output, new models and stronger international demand.

Is This The Bottom For Lucid Investors?

Currently, Lucid Group is trading 0.8% below its 20-day simple moving average (SMA) and 12.2% below its 50-day SMA, indicating short-term weakness. Over the past 12 months, the stock has decreased by 61.49% and is positioned closer to its 52-week lows than highs.

The RSI is at 31.33, which is considered neutral territory, while the MACD is below its signal line, indicating bearish pressure on the stock. The combination of neutral RSI and bearish MACD suggests mixed momentum.

- Key Resistance: $12.00

- Key Support: $11.00

Earnings Expectations Are Shifting

Investors are looking ahead to the next earnings report on Feb. 24.

- EPS Estimate: $-2.57 (Down from $-2.20 YoY)

- Revenue Estimate: $468.45 million (Up from $234.47 million YoY)

Analyst Consensus & Recent Actions: The stock carries a Hold Rating with an average price target of $25.70. Recent analyst moves include:

- Morgan Stanley: Upgraded to Underweight (Lowered Target to $10.00) (Dec. 8, 2025)

- Stifel: Hold (Lowered Target to $17.00) (Nov. 17, 2025)

- Cantor Fitzgerald: Neutral (Lowered Target to $21.00) (Nov. 6, 2025)

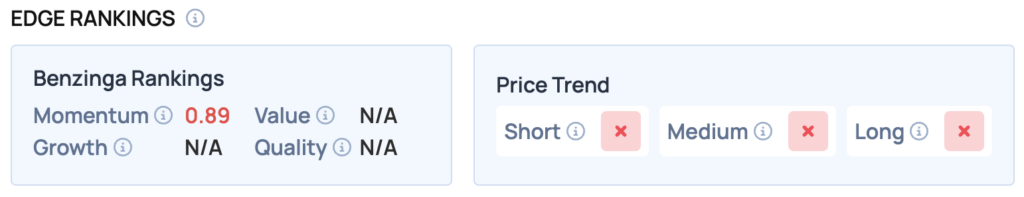

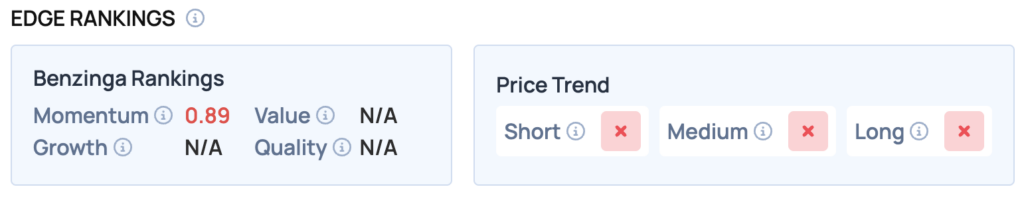

Benzinga Edge Rankings

Below is the Benzinga Edge scorecard for Lucid Group, highlighting its strengths and weaknesses compared to the broader market:

- Momentum: Bullish (Score: 0.89/100) — Stock is outperforming the broader market.

The Verdict: Lucid Group’s Benzinga Edge signal reveals a weak momentum setup, and the lack of additional rankings indicates that investors should remain cautious and monitor for further developments.

Top ETF Exposure

- SPDR S&P Kensho Smart Mobility ETF (NYSE:HAIL): 2.02% Weight

- GraniteShares 2x Long LCID Daily ETF (NASDAQ:LCDL): 200.01% Weight

LCID Shares Soar Wednesday

LCID Price Action: Lucid Group shares were up 13.77% at $11.07 at the time of publication on Wednesday, according to Benzinga Pro data.

Image: Shutterstock

Recent Comments