Netflix, Inc. (NASDAQ:NFLX) shares fell around 3% on Wednesday after the company reported fourth-quarter financial results and issued first-quarter guidance below estimates on Tuesday.

Netflix reported earnings per share of 56 cents, beating the consensus estimate of 55 cents. In addition, the company reported revenue of $12.05 billion, beating the consensus estimate of $11.97 billion.

For the first quarter, Netflix guided for earnings per share of 76 cents and revenue of approximately $12.16 billion. The company said it expects advertising revenue growth to continue and plans to invest across content, advertising initiatives and newer formats including live events, video podcasts and games.

“With over 325M paid memberships, we’re now serving an audience approaching one billion people globally. Our aim is to delight and satisfy all of them by providing an amazing variety of series, films, and games,” the company said.

Netflix shares fell 3.3% to trade $84.34 on Wednesday.

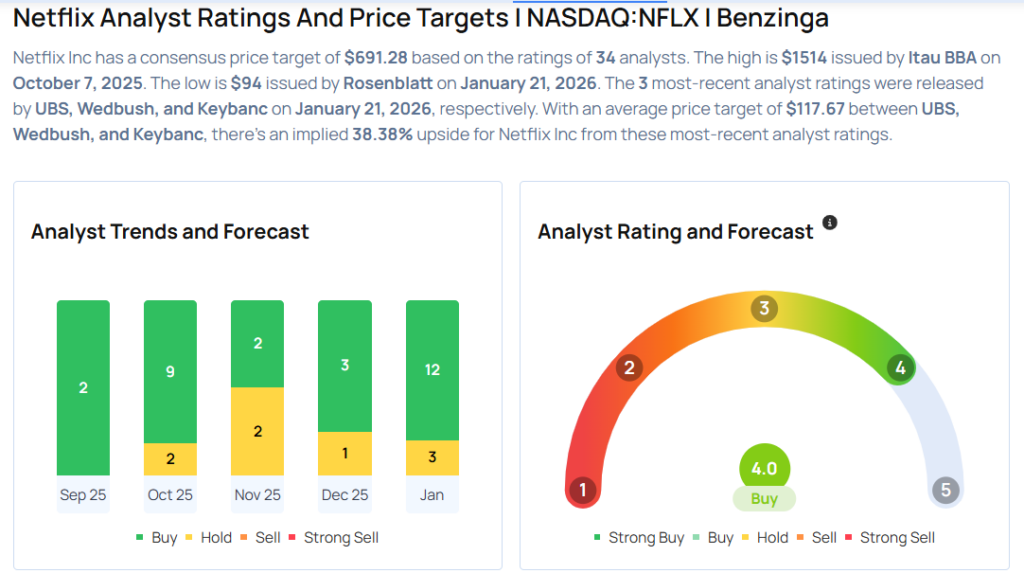

These analysts made changes to their price targets on Netflix following earnings announcement.

- Pivotal Research analyst Jeffrey Wlodarczak maintained Netflix with a Hold and lowered the price target from $105 to $95.

- Goldman Sachs analyst Eric Sheridan maintained the stock with a Neutral and lowered the price target from $112 to $100.

- Needham analyst Laura Martin maintained Netflix with a Buy and lowered the price target from $150 to $120.

- Rosenblatt analyst Barton Crockett maintained the stock with a Neutral and cut the price target from $105 to $94.

- Guggenheim analyst Michael Morris maintained Netflix with a Buy and lowered the price target from $145 to $130.

- Morgan Stanley analyst Benjamin Swinburne maintained the stock with an Overweight rating and lowered the price target from $120 to $110.

- BMO Capital analyst Brian Pitz maintained Netflix with an Outperform rating and lowered the price target from $143 to $135.

- Canaccord Genuity analyst Maria Ripps maintained the stock with a Buy and lowered the price target from $152.5 to $125.

- Keybanc analyst Justin Patterson maintained Netflix with an Overweight rating and lowered the price target from $110 to $108.

- UBS analyst John Hodulik maintained Netflix with a Buy and slashed the price target from $150 to $130.

Considering buying NFLX stock? Here’s what analysts think:

Photo via Shutterstock

Recent Comments