Kinder Morgan, Inc. (NYSE:KMI) will release earnings results for the fourth quarter, after the closing bell on Wednesday, Jan. 21.

Analysts expect the Houston, Texas-based company to report quarterly earnings at 37 cents per share, up from 32 cents per share in the year-ago period. The consensus estimate for Kinder Morgan’s quarterly revenue is $4.33 billion, up from $3.99 billion a year earlier, according to data from Benzinga Pro.

On Dec. 8, Kinder Morgan said it sees FY26 adjusted EPS of $1.37.

Kinder Morgan shares closed at $27.96 on Tuesday.

Benzinga readers can access the latest analyst ratings on the Analyst Stock Ratings page. Readers can sort by stock ticker, company name, analyst firm, rating change or other variables.

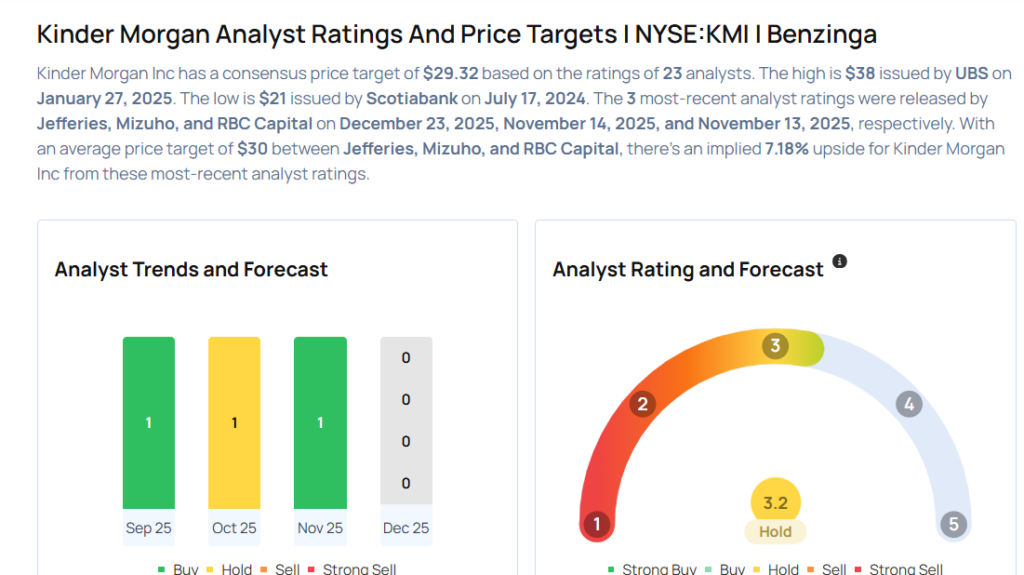

Let’s have a look at how Benzinga’s most-accurate analysts have rated the company in the recent period.

- Jefferies analyst Julien Dumoulin-Smith maintained a Hold rating and cut the price target from $30 to $29 on Dec. 23, 2025. This analyst has an accuracy rate of 65%.

- Mizuho analyst Gabe Moreen maintained an Outperform rating and lowered the price target from $32 to $31 on Nov. 14, 2025. This analyst has an accuracy rate of 63%.

- RBC Capital analyst Elvira Scotto maintained a Sector Perform rating and raised the price target from $28 to $30 on Nov. 13, 2025. This analyst has an accuracy rate of 50%.

- Stifel analyst Selman Akyol maintained a Hold rating and increased the price target from $29 to $30 on Nov. 11, 2025. This analyst has an accuracy rate of 70%.

- Morgan Stanley analyst Devin McDermott maintained an Equal-Weight rating and raised the price target from $34 to $35 on Oct. 1, 2025. This analyst has an accuracy rate of 75%.

Considering buying KMI stock? Here’s what analysts think:

Photo via Shutterstock

Recent Comments