Marvell Technology Inc (NASDAQ:MRVL) presents an intriguing case amid the Greenland drama as it’s one of the major names that’s treading water as opposed to sinking. This doesn’t mean that MRVL stock has been immune to pressure. Since the start of the year, the security is down 5% and the overall trajectory has been unconvincing since October. Still, MRVL’s reflexive potential shouldn’t be ignored.

Let’s address the giant pink elephant in the room. With President Donald Trump ratcheting up tariff threats against key European partners over a proposed U.S. takeover of Greenland, global equity markets sold off sharply. Essentially, two terrible outcomes may materialize: an unnecessary trade war or an actual kinetic conflict, which would effectively destroy the hard-earned Western alliance.

While no one knows what may happen tomorrow, the Greenland drama is probably an example of Trump’s hard-nosed tactics. Let’s not forget that the TACO trade, an acronym for “Trump Always Chickens Out,” is a thing. At some point, I’m going to trust that someone within the administration will convince the president to walk back from an extremely imprudent approach.

Further, it’s difficult to not view the geopolitical crisis over Greenland as a distraction. Sure, the political thesis surrounding U.S. control of the self-governing territory within the Kingdom of Denmark centers on the rich resources available. However, actually extracting those resources from Greenland’s harsh Arctic environment is quite another challenge.

Realistically, it may take a decade or more to provide meaningful supply of critical resources — and that will only come through extensive investments.

Going back to MRVL stock, irrespective of how this geopolitical matter plays out, investment in artificial intelligence — especially in the realm of infrastructure upgrades — is occurring at breakneck speeds. As such, any downturn in MRVL may be a potential invitation for a bullish posture.

Narrowing Down The List Of Likely Outcomes For MRVL Stock

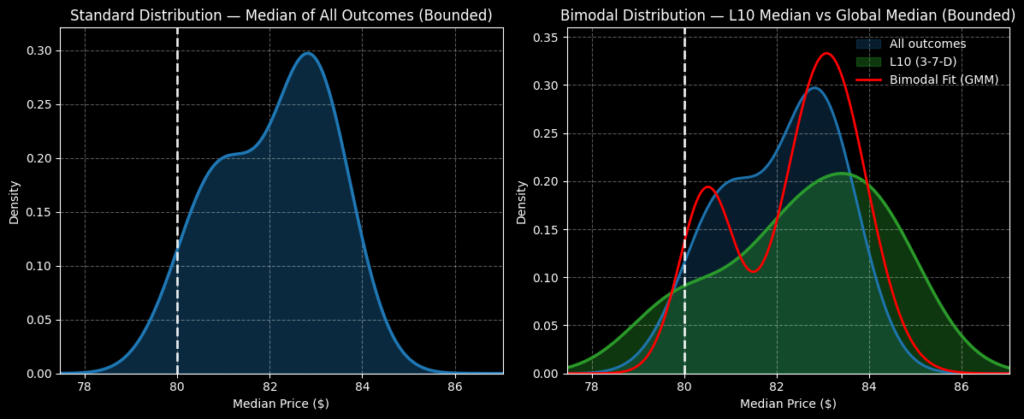

Looking a month down the road to the Feb. 20 options chain, the implied volatility (IV) of this particular expiration date currently stands at 50.73%. When this IV figure, which is a residual metric derived from actual order flows, is plugged into the Black-Scholes formula, the model spits out a wide dispersion: a lower price target of $70.89 and an upper price target of $88.55.

At first glance, this dispersion seems insightful and it genuinely is. Through this first-order analysis, we now know where the battlefield is. However, the projected range represents about an 11% high-low spread relative to the current spot price, which is quite sizable. We need some way of narrowing this list of possibilities down to a group of probabilities.

For that, we may adopt the Markov property, which claims that the future (behavioral) state of a system depends solely on the current state. In other words, forward probabilities are contextual. For instance, in football, a 20-yard field goal attempt is practically a guaranteed three points. However, add rain, crosswind and playoff pressure and suddenly, that field goal is no longer automatic.

In the past 10 weeks, MRVL stock had printed only three up weeks, leading to an overall downward slope. My hypothesis is that this 3-7-D sequence will spark a different response over the next 10 weeks than had any other sequence flashed.

Using past analogs going back to January 2019 and filtering only for the aforementioned quantitative signal, we may expect a forward distribution between $76 and $88. Over the next five weeks (thus coinciding with the Feb. 20 expiration date), the expected range would be between $78 and $88. What’s more, probability density would likely peak around $83 and $85.

By running a second-order analysis, we can now concentrate on likely outcomes instead of a wide dispersion of possible outcomes.

Going For An Aggressive But Controlled Wager

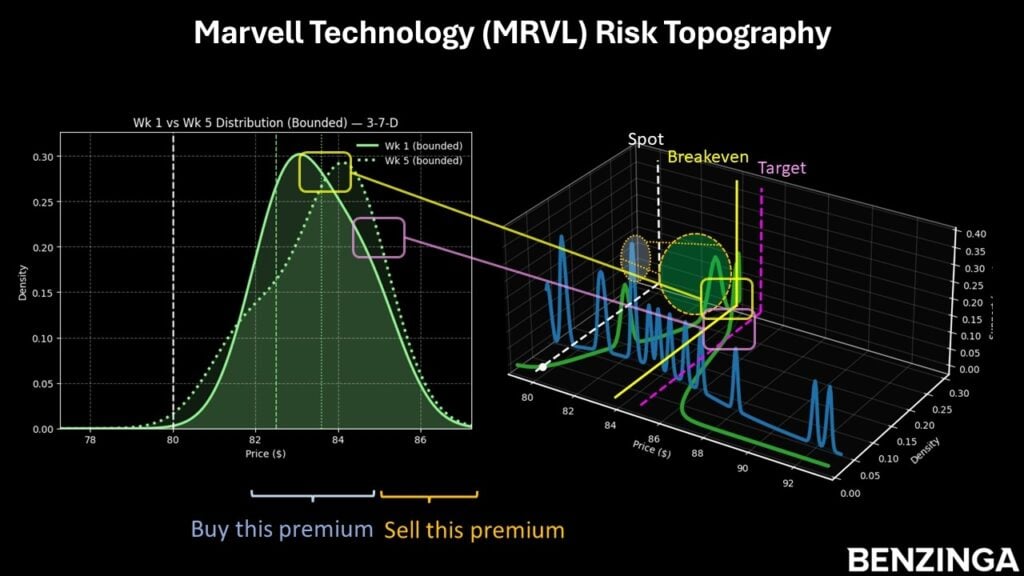

Given that MRVL stock has reflexive upside potential — which for additional context was previously demonstrated in December last year — I’m looking at the 83/85 bull call spread expiring Feb. 20. This wager involves two simultaneous transactions: buy the $83 call and sell the $85 call.

Overall, the trade requires a net debit of $83, which is also the most that can be lost. Should MRVL stock rise through the second-leg strike ($85) at expiration, the maximum profit would be $117, a payout of nearly 141%. Breakeven lands at $83.83, adding to the trade’s probabilistic credibility.

With this setup, MRVL stock over many trials of the 3-7-D sequence statistically is likely to terminate between $83 and $85. With any luck, MRVL may end up on the higher end of the projected distributional curve, potentially allowing it to trigger the $85 strike at expiration.

Finally, by calculating a second-order analysis, we’re now concentrated on likely outcomes as opposed to chasing after possible outcomes. Since debit-side traders must pay a premium for the right to speculate on events that have yet to materialize, narrowing down the range of guesses helps us to be more economical and efficient.

The opinions and views expressed in this content are those of the individual author and do not necessarily reflect the views of Benzinga. Benzinga is not responsible for the accuracy or reliability of any information provided herein. This content is for informational purposes only and should not be misconstrued as investment advice or a recommendation to buy or sell any security. Readers are asked not to rely on the opinions or information herein, and encouraged to do their own due diligence before making investing decisions.

Image: Shutterstock

Recent Comments