Bakkt Holdings Inc (NYSE:BKKT) shares are tumbling on Tuesday after the company announced a $300 million ATM equity program. Here’s what investors need to know.

- Bakkt stock is among today’s weakest performers. What’s weighing on BKKT shares?

Bakkt’s $300 Million Stock Offering

The company revealed Tuesday morning that it has established the capacity to sell up to $300 million in common stock at its sole discretion. This program is pursuant to a shelf registration statement originally filed in June 2025. Bakkt clarified that as of the announcement date, no shares have actually been sold under this new facility.

Management framed the move as a strategic step to bolster the balance sheet. According to the press release, the program is intended to “enhance financial flexibility” and position the company to “capitalize on attractive growth opportunities”.

Specifically, Bakkt plans to use potential proceeds to accelerate key initiatives, including scaling its Zaira stablecoin payments platform and expanding its global presence in Japan and India.

Despite the long-term strategic rationale, the market reacted negatively to the immediate prospect of increased share supply.

Bakkt’s Performance Signals Caution Ahead

Currently, Bakkt is trading significantly below its key moving averages, indicating bearish momentum. The stock is down 39.91% over the past 12 months, reflecting a challenging year for investors, and is positioned closer to its 52-week lows than highs, suggesting ongoing weakness.

The RSI is not available, but the MACD status indicates bearish pressure on the stock. This combination suggests that traders should be cautious, as the stock may continue to face downward momentum.

- Key Resistance: $19.00

- Key Support: $15.00

BKKT Earnings Forecast

Investors are looking ahead to the next earnings report on March 18.

- EPS Estimate: Loss of 47 cents (Up from $-2.95 YoY)

- Revenue Estimate: $279.87 million (Down from $1.80 billion YoY)

Benzinga Edge Rankings

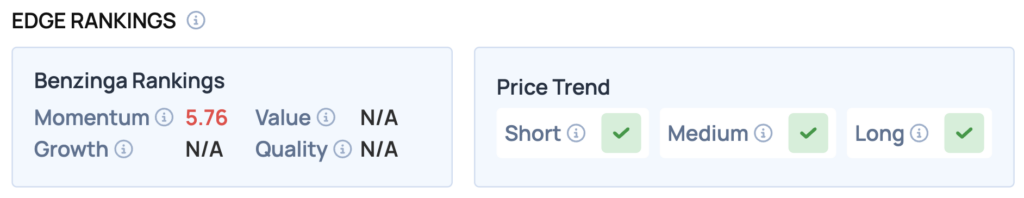

Below is the Benzinga Edge scorecard for Bakkt Holdings, highlighting its strengths and weaknesses compared to the broader market:

- Momentum: Bullish (Score: 5.76/100) — Stock is underperforming the broader market.

The Verdict: Bakkt Holdings’ Benzinga Edge signal reveals a stock struggling to gain traction. While the Momentum score indicates some bullish sentiment, the overall performance suggests that investors should approach with caution.

BKKT Shares Slide Tuesday

BKKT Price Action: Bakkt Hldgs shares were down 18.92% at $17.36 at the time of publication on Tuesday, according to Benzinga Pro data.

Image: Shutterstock

Recent Comments