3M Company (NYSE:MMM) will release earnings for the fourth quarter before the opening bell on Tuesday, Jan. 20.

Analysts expect the company to report fourth-quarter earnings of $1.80 per share. That’s up from $1.68 per share in the year-ago period. The consensus estimate for 3M’s quarterly revenue is $6.02 billion (it reported $5.81 billion last year), according to Benzinga Pro.

On Oct. 21, 3M reported better-than-expected third-quarter earnings and raised FY2025 EPS guidance.

Shares of 3M fell 1.9% to close at $167.80 on Friday.

Benzinga readers can access the latest analyst ratings on the Analyst Stock Ratings page. Readers can sort by stock ticker, company name, analyst firm, rating change or other variables.

Let’s have a look at how Benzinga’s most-accurate analysts have rated the company in the recent period.

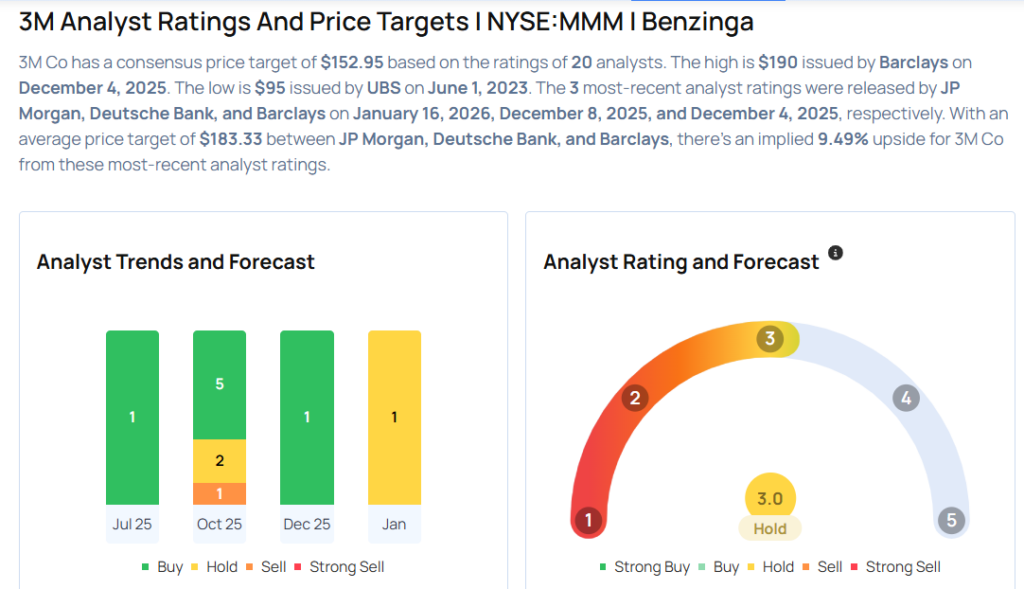

- JP Morgan analyst Stephen Tusa downgraded the stock from Outperform to Neutral with a price target of $182 on Jan. 16, 2026. This analyst has an accuracy rate of 67%.

- Deutsche Bank analyst Nicole Deblase downgraded the stock from Buy to Hold and cut the price target from $199 to $178 on Dec. 8, 2025. This analyst has an accuracy rate of 79%.

- Barclays analyst Julian Mitchell maintained an Overweight rating and increased the price target from $180 to $190 on Dec. 4, 2025. This analyst has an accuracy rate of 75%.

- UBS analyst Amit Mehrotra maintained the stock with a Buy rating and raised the price target from $184 to $190 on Oct. 22, 2025. This analyst has an accuracy rate of 74%.

- Morgan Stanley analyst Chris Snyder upgraded the stock from Underweight to Equal-Weight and raised the price target from $130 to $160 on Oct. 22, 2025. This analyst has an accuracy rate of 76%

Considering buying MMM stock? Here’s what analysts think:

Photo via Shutterstock

Recent Comments