Coinbase Global Inc. (NASDAQ:COIN) announced Monday its support for Bermuda’s ambitious plan to become the world’s first “fully on-chain national economy.”

Bermuda’s Leap Into On-Chain Finance

The announcement was made at the World Economic Forum Annual Meeting in Davos. The Government of Bermuda, in collaboration with Coinbase and Circle Internet Group Inc. (NYSE:CRCL), intends to transform the nation’s economy through the use of digital asset infrastructure and enterprise tools in administration, local banks, insurers and businesses.

The initiative also includes nationwide digital finance education and technical onboarding.

“With the support of Circle and Coinbase, two of the world’s most trusted digital finance companies, we are accelerating our vision to enable digital finance at the national level,” said Bermuda Premier E. David Burt.

Brian Armstrong, CEO of Coinbase, expressed his excitement about the project, stating, “Excited to support Bermuda’s transition toward an on-chain economy that empowers the people, local businesses, and institutions. Open financial systems will drive economic freedom.”

Circle CEO Jeremy Allaire said he was “thrilled” to be part of the “ambitious” project.

Bermuda’s Regulatory Framework

Bermuda enacted the Digital Asset Business Act in 2018, establishing a clear regulatory framework for cryptocurrencies and related companies. Coinbase obtained a license to operate in Bermuda back in 2023.

Note that Bermuda is a self-governing British Overseas Territory, with its defence and external affairs controlled by the UK.

The Push For Crypto Regulation In The US

Armstrong has been actively engaging with the White House and Congress to advance a similar bill in the U.S., which seeks to establish a federal regulatory framework for digital assets.

In a video shared on X, Armstrong stated that he intends to discuss with world leaders the advantages of cryptocurrency in strengthening their financial systems. He also said that the efforts to push the cryptocurrency market structure bill would continue.

Coinbase withdrew its support for the cryptocurrency market structure bill, hours before lawmakers were set to vote on the legislation. The withdrawal led to an indefinite postponement of the bill’s markup.

Price Action: Coinbase shares closed 0.78% higher at $241.15 on Friday, according to data from Benzinga Pro. Circle shares closed 2.62% higher at $78.61.

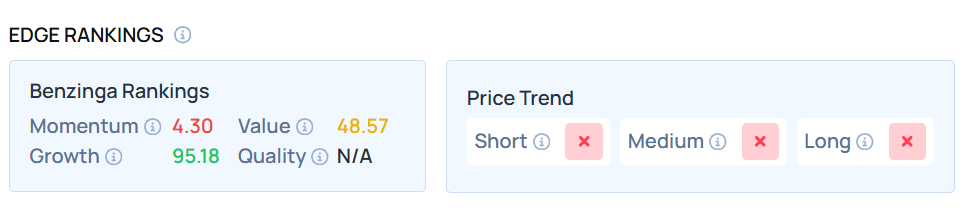

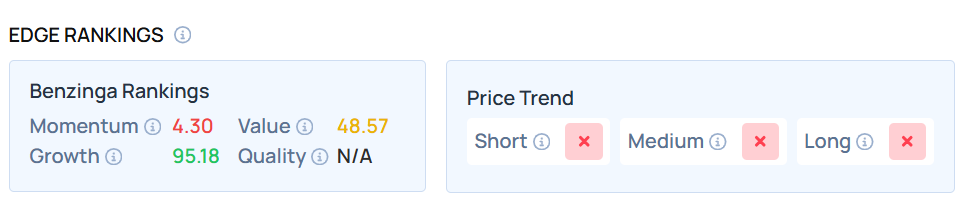

COIN stock maintains a weaker price trend over the short, medium, and long terms with a high Growth ranking, according to Benzinga’s Edge Stock Rankings.

Photo Courtesy: Alexandru Nika on Shutterstock.com

Recent Comments