The New York Stock Exchange, a subsidiary of Intercontinental Exchange, Inc. (NYSE:ICE), said on Monday it is developing a platform for the trade and on-chain settlement of tokenized securities.

A Game Changer?

The exchange said in a press release that it would seek regulatory approval for the new digital platform. This platform aims to boost tokenized trading experiences by offering 24/7 operations of U.S.-listed stocks and exchange-traded funds, instant settlement, fractional share trading and stablecoin-based funding.

The proposed platform will include support for “multiple chains” for settlement and custody. Tokenized shareholders will have the opportunity to participate in traditional shareholder dividends and governance rights.

“We are leading the industry toward fully on-chain solutions, grounded in the unmatched protections and high regulatory standards that position us to marry trust with state-of-the-art technology, said Lynn Martin, President, NYSE Group.

‘Access To Best Companies For World Citizens’

Galaxy Digital Inc. (NASDAQ: GLXY) CEO Mike Novogratz said tokenizing equities is an “amazing tool” to promote U.S. brands and excellence to the rest of the world.

“Access to the best companies for the world’s citizens. That is why tokenized assets matter,” Novogratz added, highlighting how countries from the global south could get to own shares of Apple Inc. (NASDAQ:AAPL) and Alphabet Inc. (NASDAQ:GOOGL) (NASDAQ:GOOG).

Binance (CRYPTO: BNB) co-founder Changpeng Zhao hailed the move as “bullish” for the industry.

Regulatory Hurdles Ahead?

The NYSE’s move into tokenized securities trading follows a similar proposal by Nasdaq Inc. (NASDAQ:NDAQ) last year to allow member firms and investors to tokenize equity securities and ETFs traded on the exchange. Nasdaq submitted a filing to the SEC in this regard.

However, the sector faces regulatory challenges. Last week, Coinbase Global Inc. (NASDAQ:COIN) withdrew its support for the Senate Banking Committee’s crypto market structure bill over a clause prohibiting on-chain versions of stocks and other real-world assets.

Currently, tokenized equities are not available for trading in the U.S., but firms are experimenting with the concept.

Coinbase called the concept a “huge priority” for the company, while Robinhood Markets Inc. (NASDAQ:HOOD) launched tokenized stocks for its European customers last year.

Price Action: ICE shares closed 0.40% higher at $173.98 on Friday, according to data from Benzinga Pro. Over the last year, the stock has gained 14.67%.

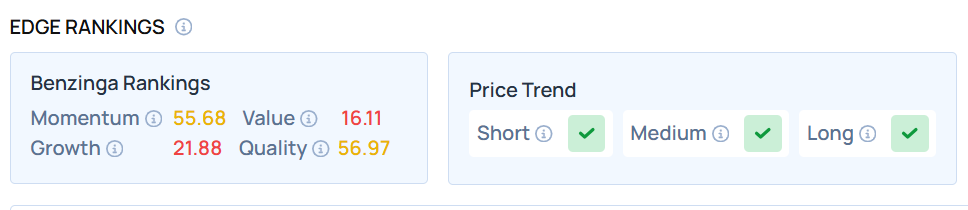

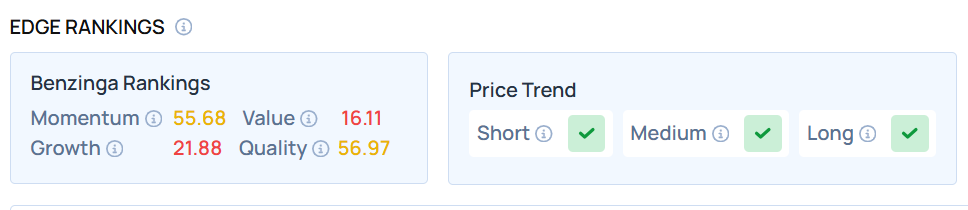

LLY maintains a stronger price trend over the short, medium, and long terms, with an average Momentum ranking, according to Benzinga’s Edge Stock Rankings.

Photo Courtesy: M. Knijnenburg on Shutterstock.com

Disclaimer: This content was partially produced with the help of Benzinga Neuro and was reviewed and published by Benzinga editors.

Recent Comments