‘Big Short’ investor Michael Burry endorsed Actor and filmmaker Ben Affleck’s recent critique of AI, signaling strong agreement with the Hollywood star’s skepticism regarding the technology.

AI Output Is ‘Not Reliable’

On Sunday, in a post on X, Burry shared a recent snippet featuring Affleck in an episode of the Joe Rogan Experience podcast, in which Affleck criticized the current capabilities of large language models such as ChatGPT, Claude and Gemini, arguing that their output was fundamentally “not reliable.”

Burry said that Affleck was “clearly a smart guy,” while calling his arguments familiar and “on point.” Burry also said that it was “delivered much better than I ever could.”

On the podcast, Affleck argued that the models are designed to reflect the “average,” making them incapable of replacing genuine human creativity.

While acknowledging certain narrow use-cases for the technology, Affleck expressed doubt that AI will ever produce truly meaningful writing, and brushed aside claims that it could one day generate entire films on its own.

He also questioned the economics of AI models, noting that performance gains were slowing while costs were rising. “ChatGPT 5.0 [is] about 25% better than ChatGPT 4.0 and costs about four times as much in the way of electricity and data,” he said.

Affleck concluded that AI will remain a tool rather than a replacement for artists. “It’s going to be good at filling in all the places that are expensive and burdensome,” he said, but “fundamentally,” it will rely on human artistic aspects.

Burry Warns About AI Bubble

Burry has repeatedly warned about an impending AI bubble burst in recent months, recently criticizing tech giants Microsoft Corp. (NASDAQ:MSFT) and Alphabet Inc. (NASDAQ:GOOGL) (NASDAQ:GOOG) for making heavy investments in infrastructure, which he said will soon become obsolete.

He recently announced that he was betting against NVIDIA Corp. (NASDAQ:NVDA), calling it “simply the purest play” on artificial intelligence, and dangerously reliant on the AI infrastructure build out.

He has also accused leading AI companies of “suspicious revenue recognition” and understating depreciation, referring to the circular funding loops between the companies “as a picture of fraud, not a flywheel.”

The Roundhill Generative AI & Technology ETF (NYSE:CHAT) was up 41.36% in 2025, and is up 139.89% over the past five years. It currently trades at a price-to-earnings ratio of 30, which is ahead of the S&P 500’s average of 28.

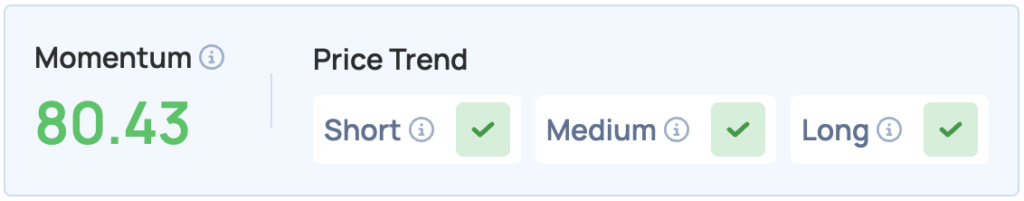

The fund scores high on Momentum in Benzinga’s Edge Stock Rankings, with a favorable price trend in the short, medium and long terms.

Image via Shutterstock

Recent Comments