Investor Gary Black, managing director of the Future Fund LLC, has predicted that automakers not investing in autonomous driving technology risk experiencing a “BlackBerry Ltd. (NYSE:BB) moment.”

Autonomous Driving Is The Name Of The Game

In a post on the social media platform X on Sunday, the investor weighed in on a debate surrounding Tesla Inc.‘s (NASDAQ:TSLA) autonomous driving exploits, which a user @Genma_JP claims would prove to be an “insurmountable moat” for other companies.

The investor shared that his question about autonomous vehicles was from the perspective of “competitive advantage, not product superiority.” He then shared that the user answered his questions from a technical perspective, similar to earlier encounters when the investor shared skepticism about Tesla delivering “20M EVs per year by 2030.”

“I agree there is a Blackberry moment coming for OEMs who can’t solve for unsupervised autonomy,” the investor shared, but also shared that he did not think that the Elon Musk-led automaker would be the “winner-take-all in autonomy.”

A Blackberry moment refers to when Blackberry, which primarily made keypad-based phones based on its own software, was left behind with the advent of touchscreen smartphones with Apple Inc.‘s (NASDAQ:AAPL) iOS, as well as Alphabet Inc.‘s (NASDAQ:GOOGL) (NASDAQ:GOOG) Android.

He then questioned why Tesla’s Full Self-Driving (FSD) technology’s adoption rate hovered around 15%, arguing that it was because customers weren’t “aware of FSD’s benefits or technical superiority.”

FSD As A Subscription

It’s worth noting that Musk recently announced that Tesla would offer the FSD technology only as a subscription, only after Valentine’s Day this year. The service will be available only with a $99/month fee.

The move could help drive adoption rates of the technology, which is one of the crucial milestones outlined in Musk’s new trillion-dollar pay package. The package has outlined that Tesla must achieve 10 million active FSD subscriptions.

Elon Musk On TSLA

Musk shared that he had not sold Tesla stock for about 3 years, adding that he has also invested in acquiring more Tesla shares, buying almost a billion dollars’ worth of Tesla stock in 2025.

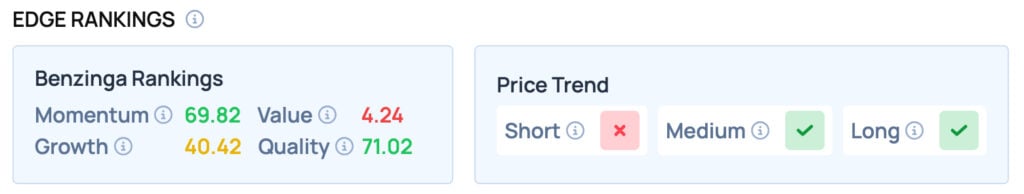

According to Benzinga Edge Rankings, Tesla scores well on Momentum and offers a favorable price trend in the Medium and Long term.

Price Action: TSLA slipped 0.24% to $437.50 at Market close on January 16, slipping 0.01% further to $437.44 during the After-hours trading.

Photo Courtesy: Scharfsinn on Shutterstock.com

Check out more of Benzinga’s Future Of Mobility coverage by following this link.

Recent Comments