BOK Financial Corporation (NASDAQ:BOKF) will release earnings for the fourth quarter before the opening bell on Friday, Jan. 16.

Analysts expect the Tulsa, Oklahoma-based company to report fourth-quarter earnings of $2.16 per share. That’s up from $2.12 per share in the year-ago period. The consensus estimate for BOK Financial’s quarterly revenue is $549.37 million (it reported $525.56 million last year), according to Benzinga Pro.

On Oct. 20, BOK Financial posted better-than-expected third-quarter earnings.

Shares of BOK Financial gained 2.1% to close at $127.69 on Thursday.

Benzinga readers can access the latest analyst ratings on the Analyst Stock Ratings page. Readers can sort by stock ticker, company name, analyst firm, rating change or other variables.

Let’s have a look at how Benzinga’s most-accurate analysts have rated the company in the recent period.

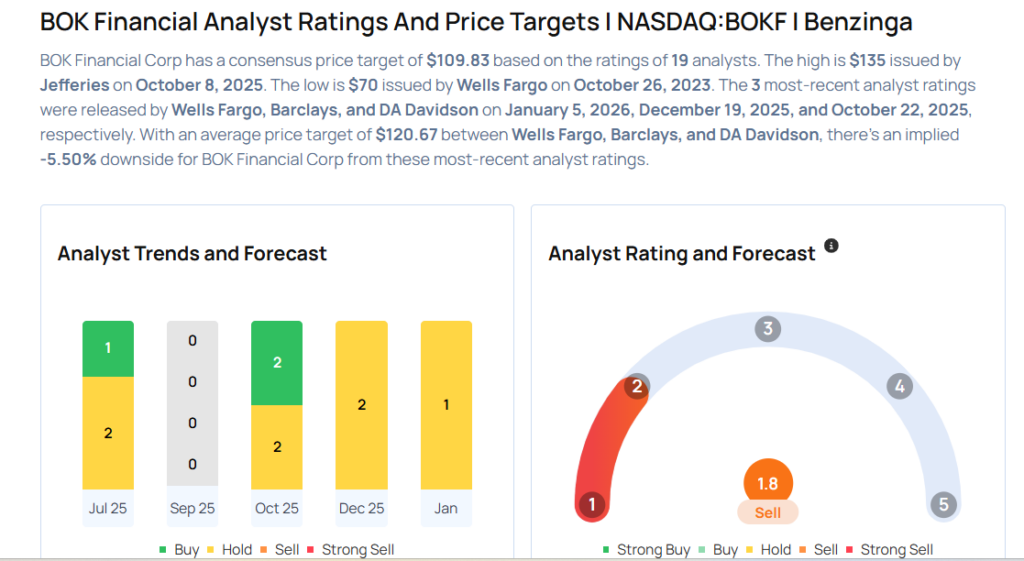

- Wells Fargo analyst Timur Braziler maintained an Equal-Weight rating and raised the price target from $105 to $115 on Jan. 5, 2026. This analyst has an accuracy rate of 66%.

- Barclays analyst Jared Shaw maintained an Equal-Weight rating and increased the price target from $120 to $125 on Dec. 19, 2025. This analyst has an accuracy rate of 70%.

- Hovde Group analyst Brett Rabatin downgraded the stock from Outperform to Market Perform on Dec. 12, 2025. This analyst has an accuracy rate of 61%.

- DA Davidson analyst Peter Winter maintained the stock with a Buy rating and raised the price target from $120 to $122 on Oct. 22, 2025. This analyst has an accuracy rate of 75%.

- Keefe, Bruyette & Woods analyst Wood Lay maintained the stock with a Market Perform rating and cut the price target from $118 to $116 on Oct. 22, 2025. This analyst has an accuracy rate of 65%

Considering buying BOKF stock? Here’s what analysts think:

Photo via Shutterstock

Recent Comments