Investment management company BlackRock Inc. (NYSE:BLK) is placing its biggest strategic wager yet on private markets, outlining a plan to raise $400 billion in gross private-market assets by 2030 as the firm pushes deeper into retirement accounts, insurance portfolios and digital finance.

Private Market Inflows Soar

During the company’s fourth-quarter earnings call on Thursday, CFO Martin Small noted that its scaled private market platform “delivered $40 billion of full-year net inflows led by private credit and infrastructure.”

Martin added that BlackRock was targeting “$400 billion in gross private markets fundraising through 2030,” which he said will be powered by the asset management giant’s robust origination infrastructure, decades of strong investment performance and longstanding client relationships.

BlackRock is trying to move private-market investments out of the exclusive world of institutions and rich investors and into mainstream retirement accounts.

Chairman and CEO Larry Fink said the firm plans to reshape how target-date funds are built, saying, “We expect to launch our first LifePath target date fund with private markets later this year.”

He said that retirement income and alternative assets should no longer be treated as separate ideas, adding that “BlackRock can bring it all together.”

The company noted that technology and data were central to this push, highlighting its $3.5 billion acquisition of private markets data company, Preqin, along with its Aladdin investment management platform.

“We’re working on building investable indices that we hope to bring to market here in the next few years,” Small said, adding that the firm aims to “build the machine for the indexing of the private markets.”

During the call, Fink also highlighted the growing role of tokenization in the company’s big foray into private markets, saying that investors could hold tokenized money-market funds alongside other assets going forward, essentially making illiquid assets easier to benchmark, package and distribute.

Stock Rallies On Earnings Beat, Record AUM

BlackRock shares surged 5.93% on Thursday, closing at $1,156.65, following the company’s fourth-quarter results, where it reported $7.01 billion in revenue, up 23% year-over-year, and ahead of Street expectations at $6.69 billion, and adjusted earnings at $13.16 per share, topping consensus estimates at $12.09.

The company’s total assets under management soared to $14 trillion, up from $11 trillion during the same period last year, with $698 billion in full-year net inflows.

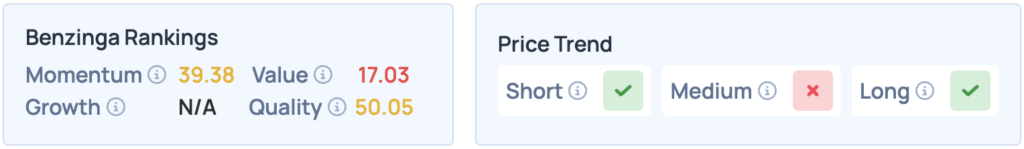

Shares of BlackRock score poorly on Momentum and Quality in Benzinga’s Edge Stock Rankings, with a favorable price trend in the short and long terms.

Photo Courtesy: Tada Images on Shutterstock.com

Recent Comments