Coinbase Global Inc (NASDAQ:COIN) and Robinhood Markets Inc (NASDAQ:HOOD) slumped on Thursday as fresh turmoil around a long-awaited U.S. crypto market-structure bill rattled investors.

Here’s what investors need to know.

- Robinhood Markets shares are consolidating. What’s ahead for HOOD stock?

Coinbase, Robinhood Stocks Drop After Armstrong Blasts Draft Bill

Thursday’s sell-off followed Coinbase CEO Brian Armstrong’s announcement that the exchange can no longer support the latest Senate Banking Committee draft.

In a post on X, Armstrong warned the bill would effectively ban tokenized equities, impose sweeping DeFi surveillance, erode the CFTC’s authority in favor of the SEC and “kill” rewards on stablecoins, arguing that no bill is better than what he called a materially worse status quo.

Senate Delay Fuels Uncertainty Around Crypto Regulation

Hours later, Committee Chair Sen. Tim Scott said markup of the legislation would be put on hold for a “brief pause,” even as he insisted all sides remain at the table.

Sen. Cynthia Lummis called industry pushback “deeply disappointing,” while investor David Sacks and Galaxy Digital CEO Mike Novogratz urged negotiators to use the delay to finish a workable compromise.

A separate Galaxy Research note this week put the odds of a truly bipartisan bill at just 25%, warning failure could push any comprehensive framework out to 2027.

Robinhood CEO Slams Gridlock As HOOD Shares Fall

Robinhood CEO Vlad Tenev added to the pressure, blasting “legislative gridlock” that keeps staking unavailable in four U.S. states and blocks tokenized stocks that the broker already offers in Europe. He urged Congress to pass rules that “protect consumers and unlock innovation.

Why The Crypto Market Structure Bill Is Critical For Coinbase

For Coinbase, the market structure bill is existential because it will define whether its U.S. business can scale under clear, durable rules or remain trapped in case-by-case enforcement fights.

The draft language Armstrong opposes would effectively bar tokenized equities, sharply restrict DeFi and stablecoin rewards, and tilt power from the CFTC toward the SEC, directly constraining several of Coinbase’s highest-potential product lines and future revenue streams.

A constructive version of the bill could instead clarify which assets are securities, create a licensed path for crypto exchanges, unlock institutional demand that currently sits on the sidelines, lower Coinbase’s regulatory and litigation overhang and prevent further migration of trading volumes to offshore platforms.

Why The Crypto Market-Structure Bill Matters For Robinhood (HOOD)

For Robinhood, the bill is just as pivotal because it will govern whether the company can fully integrate crypto into its low-cost brokerage super app vision in the U.S.

A clear federal framework could harmonize state and federal rules, specify which tokens a retail broker may safely list, create compliant pathways for staking and tokenized equities, reduce headline regulatory risk and allow Robinhood to continue to compete on innovation.

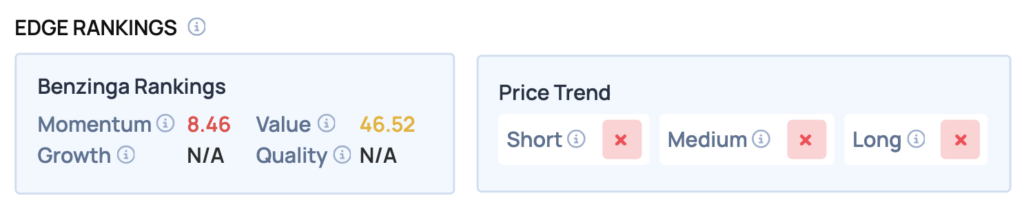

COIN Benzinga Edge Rankings

Benzinga Edge stock rankings give you four critical scores to help identify the strongest and weakest stocks, and for Coinbase, the platform assigns a Momentum score of 8.46, signaling heightened volatility in the current market environment.

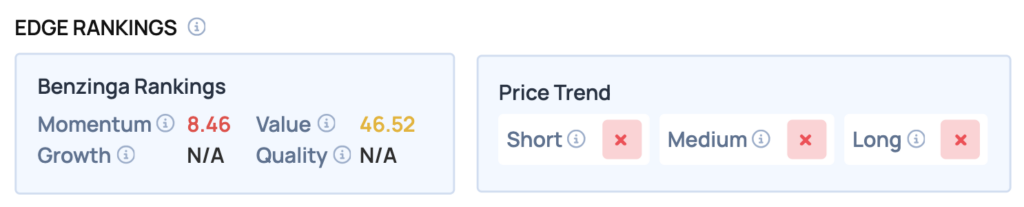

HOOD Benzinga Edge Rankings

For HOOD, Benzinga Edge assigns a 94.33 Momentum score alongside a 91.00 Growth score, highlighting unusually strong performance despite recent volatility.

COIN, HOOD Stocks Fall Sharply Thursday

COIN Price Action: Coinbase Global shares closed Thursday down 6.48% and up 0.57% in after-hours trading, last trading at $240.65, according to Benzinga Pro data.

HOOD Price Action: Robinhood Markets shares closed Thursday down 7.79% and up 1.47% in after-hours trading, last trading at $111.97.

Image: Shutterstock

Recent Comments