Vail Resorts Inc (NYSE:MTN) shares are trading lower Thursday morning after the ski-resort operator reported weaker early-season metrics and warned full-year earnings will miss prior expectations. Here’s what investors need to know.

- Vail Resorts stock is trading at depressed levels. What’s next for MTN stock?

The Snowfall Crisis: A 30-Year Low

For the North American destination resorts and regional ski areas, season-to-date skier visits through Jan. 4 fell 20.0% from a year earlier. Total lift revenue, including the portion of season-pass revenue allocated to the period, declined 1.8%, while ski school revenue dropped 14.9%, dining revenue slid 15.9% and retail and rental revenue at resort and ski-area stores decreased 6.0%.

Chief Executive Rob Katz said the company “experienced one of the worst early season snowfalls in the western U.S. in over 30 years,” noting snowfall at western U.S. resorts in November and December was about “50% below the historical 30-year average.” In the Rockies, snowfall was down nearly 60%, leaving only about 11% of terrain open in December.

Vail’s EBITDA Outlook: A Cautionary Tale

Given those conditions, Vail now expects full-year Resort Reported EBITDA to come in “just below the low end of the guidance range” issued on Sept. 29, 2025, and cautioned that weaker-than-expected improvement in the Rockies could drive “further downside” to that outlook.

The guidance also relies on normal weather for the rest of the 2025/26 North American ski season and typical passholder usage. Vail in December said fiscal 2026 reported EBITDA is expected to range from $842 million to $898 million.

Katz said he was proud of the team’s “resilience and exceptional execution,” but the market remains focused on the weather-driven revenue shortfall and reduced profit outlook.

Analyzing Key Support And Resistance Levels

The stock is currently trading 2.6% below its 20-day simple moving average (SMA) and 7.0% below its 100-day SMA, indicating a bearish trend in the short to medium term. Shares have decreased by 22.80% over the past 12 months and are positioned closer to their 52-week lows than highs, reflecting ongoing challenges in the market.

The RSI is at 52.03, which is considered neutral territory, suggesting that the stock is neither overbought nor oversold. Meanwhile, MACD is above its signal line, indicating a bullish momentum that could provide some support for the stock.

The combination of neutral RSI and bullish MACD suggests mixed momentum, which traders should watch closely for potential shifts in direction.

- Key Resistance: $163.50

- Key Support: $129.50

Analysts Are Divided Ahead Of Earnings

Investors are looking ahead to the next earnings report on March 9.

- EPS Estimate: $6.53 (Down from $6.56 YoY)

- Revenue Estimate: $1.14 billion (Down from $1.14 billion YoY)

- Valuation: P/E of 20.5x (Indicates fair valuation)

Analyst Consensus & Recent Actions: The stock carries a Hold Rating with an average price target of $178.54. Recent analyst moves include:

- Jefferies: Upgraded to Buy (Raised Target to $165.00) (Jan. 13)

- Truist Securities: Buy (Lowered Target to $234.00) (Dec. 29, 2025)

- Morgan Stanley: Equal-Weight (Lowered Target to $151.00) (Dec. 23, 2025)

Valuation Insight: While the stock trades at a fair P/E multiple, the consensus and 0% expected earnings decline suggest analysts view this growth as justification for the 30% upside to analyst targets.

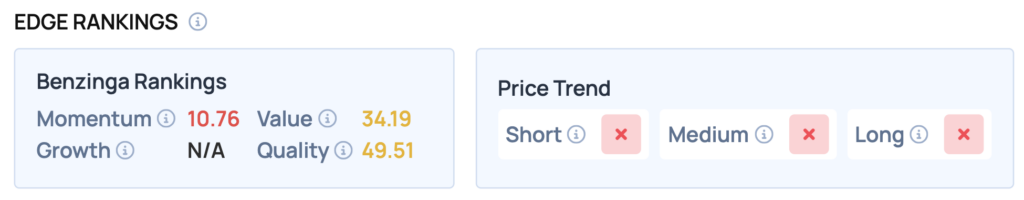

Benzinga Edge Rankings

Below is the Benzinga Edge scorecard for Vail Resorts, highlighting its strengths and weaknesses compared to the broader market:

- Momentum: Weak (Score: 10.76/100) — Stock is underperforming the broader market.

- Quality: Neutral (Score: 49.51/100) — Balance sheet remains stable.

- Value: Risk (Score: 34.19/100) — Trading at a premium relative to peers.

The Verdict: Vail Resorts’ Benzinga Edge signal reveals a challenging landscape for the stock. While the Quality score indicates stability, the low Momentum score suggests that investors should be cautious as the stock struggles to find upward traction.

Top ETF Exposure

- Leatherback Long/Short Alternative Yield ETF (NYSE:LBAY): 5.77% Weight

Significance: Because MTN carries significant weight in these funds, any significant inflows or outflows for these ETFs will likely force automatic buying or selling of the stock.

Price Action

MTN Price Action: Vail Resorts shares were down 0.64% at $141.71 at the time of publication on Thursday, according to Benzinga Pro data.

Image: Shutterstock

Recent Comments