Bank of America Corp (NYSE:BAC) reported upbeat fourth-quarter fiscal 2025 financial results on Wednesday.

The bank reported a net income of $7.6 billion (down from $6.80 billion a year ago) and EPS of 98 cents, beating the analyst consensus estimate of 96 cents. Revenue, net of interest expense, increased 7% year-over-year (Y/Y) to $28.532 billion, beating the analyst consensus estimate of $27.944 billion.

“We delivered on our commitments to shareholders across the year with solid growth across revenue, earnings and returns,” Bank of America CEO Brian Moynihan said of the results.

Bank of America shares rose 0.2% to trade $52.59 on Thursday.

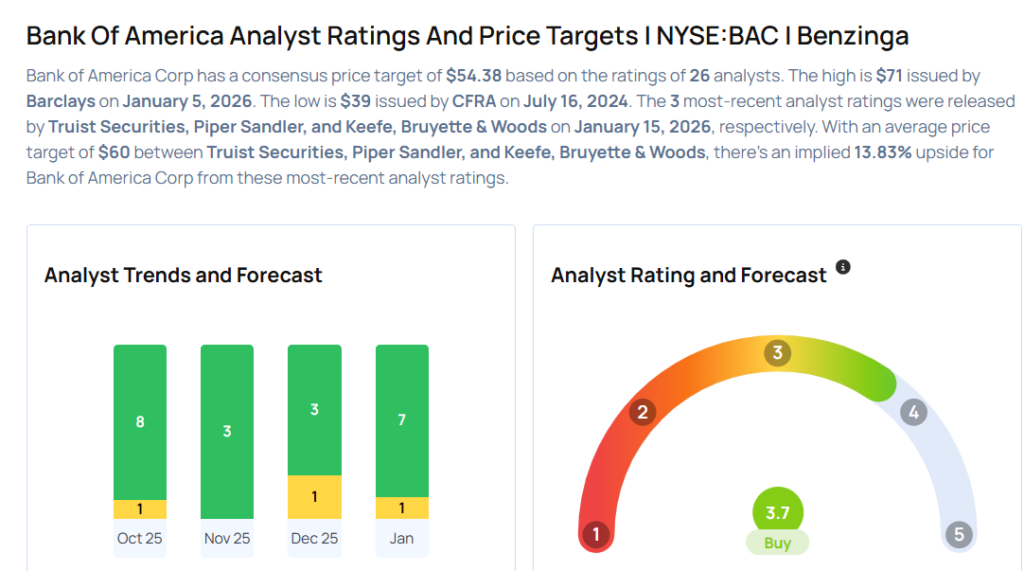

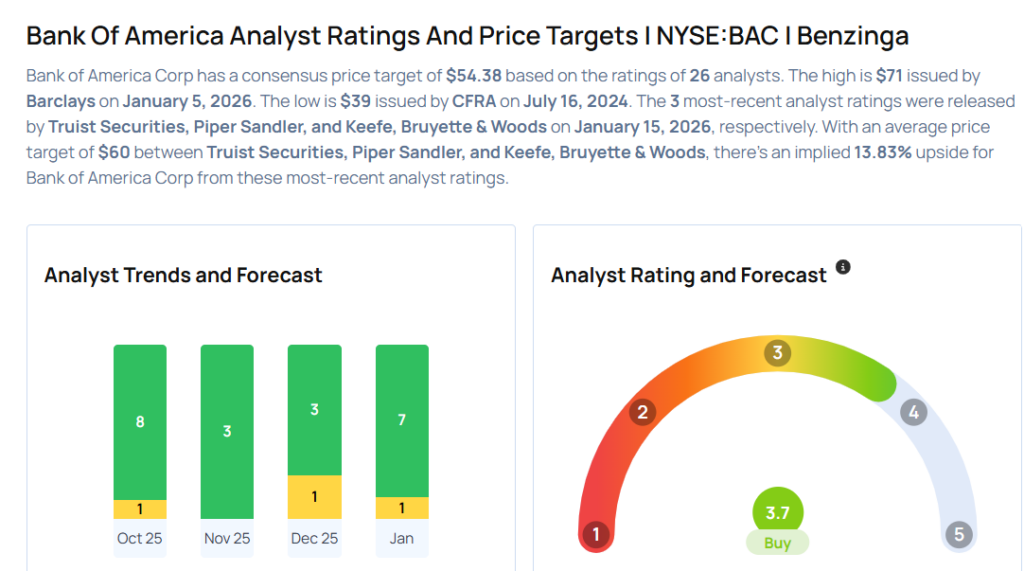

These analysts made changes to their price targets on Bank of America following earnings announcement.

- Keefe, Bruyette & Woods analyst Christopher McGratty maintained Bank of America with an Outperform rating and lowered the price target from $64 to $63.

- Piper Sandler analyst Scott Siefers maintained the stock with a Neutral and raised the price target from $56 to $57.

- Truist Securities analyst John McDonald maintained Bank of America with a Buy and lowered the price target from $62 to $60.

Considering buying BAC stock? Here’s what analysts think:

Photo via Shutterstock

Recent Comments