U.S. stock futures rose on Thursday following Wednesday’s decline. Futures of major benchmark indices were higher.

The Nasdaq Composite fell 1% on Wednesday as reports of a 25% tariff on select semiconductor imports overshadowed U.S. approval for exports to China. Meanwhile, tariff uncertainty persists as the Supreme Court again delayed its ruling on the framework’s legality.

Meanwhile, the 10-year Treasury bond yielded 4.15%, and the two-year bond was at 3.52%. The CME Group’s FedWatch tool‘s projections show markets pricing a 95% likelihood of the Federal Reserve leaving the current interest rates unchanged in January.

| Index | Performance (+/-) |

| Dow Jones | 0.11% |

| S&P 500 | 0.36% |

| Nasdaq 100 | 0.75% |

| Russell 2000 | 0.16% |

The SPDR S&P 500 ETF Trust (NYSE:SPY) and Invesco QQQ Trust ETF (NASDAQ:QQQ), which track the S&P 500 index and Nasdaq 100 index, respectively, were higher in premarket on Wednesday. The SPY was up 0.34% at $692.68, while the QQQ advanced 0.71% to $623.95.

Stocks In Focus

Goldman Sachs Group

- Goldman Sachs Group Inc. (NYSE:GS) was 0.44% lower in premarket on Thursday as analysts expect it to report quarterly earnings before the opening bell. Wall Street expects earnings of $11.65 per share on revenue of $13.79 billion.

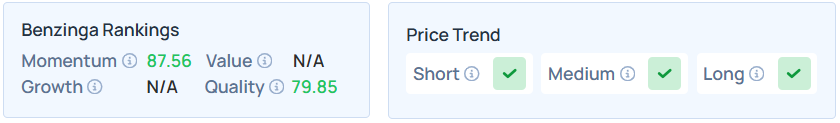

- Benzinga’s Edge Stock Rankings show that GS maintains a stronger price trend over the short, medium, and long term, with a solid quality ranking.

Taiwan Semiconductor Manufacturing

- Taiwan Semiconductor Manufacturing Co. Ltd. (NYSE:TSM) gained 4.46% after it reported a 35% surge in its profit for the fourth quarter, also topping estimates. Its net profit jumped to T$505.7 billion ($16 billion), recording its seventh consecutive quarter of double-digit growth. Meanwhile, ASML Holding NV (NASDAQ:ASML) also rose 4.93% to top a $500 billion market cap.

- Benzinga’s Edge Stock Rankings indicate that TSM maintains a stronger price trend over short, medium, and long term, with a poor value ranking.

Applied Materials

- Applied Materials Inc. (NASDAQ:AMAT) rose 6% after Susquehanna analyst Mehdi Hosseini upgraded the stock to ‘Positive’ from ‘Neutral,’ upping the price target to $400, up from $180.

- It maintains a stronger price trend over the short, medium, and long term with a solid quality ranking, as per Benzinga’s Edge Stock Rankings.

Amazon.com

- Amazon.com Inc. (NASDAQ:AMZN) was up 0.67% after Amazon Web Services (AWS) launched a new European Sovereign Cloud with a €7.8 billion or $9.1 billion investment.

- AMZN maintains a stronger price trend over the short, medium, and long terms with a moderate value ranking, as per Benzinga’s Edge Stock Rankings.

Calavo Growers

- Calavo Growers Inc. (NASDAQ:CVGW) shares surged 12.93% despite posting downbeat results for the fourth quarter. However, Mission Produce announced plans to acquire Calavo at $27 per share.

- CVGW maintains a stronger price trend over the short, medium, and long terms, with a poor growth ranking, as per Benzinga’s Edge Stock Rankings.

Cues From Last Session

While energy, consumer staples, and real estate stocks recorded the biggest gains on Wednesday, consumer discretionary and information technology sectors slid, pulling the broader U.S. market lower.

| Index | Performance (+/-) | Value |

| Dow Jones | -0.086% | 49,149.63 |

| S&P 500 | -0.53% | 6,926.60 |

| Nasdaq Composite | -1.00% | 23,471.75 |

| Russell 2000 | 0.70% | 2,651.64 |

Insights From Analysts

BlackRock maintains an optimistic outlook for the U.S. market, keeping an overweight stance on equities driven by “solid U.S. economic growth” and the transformative potential of artificial intelligence.

A key driver for this confidence is the observation that “U.S. corporate earnings strength is broadening,” meaning the profit growth previously concentrated in the Magnificent 7 is now extending to other sectors.

Economically, the firm sees a unique environment where “mega forces are trumping the traditional macro in driving returns.” This shift supports their preference for AI and cyclical sectors like industrials and materials, which benefit from infrastructure and data center buildouts.

They characterize the labor market as being in a “no hiring, no firing” stasis, which supports consumption without overheating.

Despite this positivity, BlackRock remains vigilant, noting that renewed wage gains could signal “sticky inflation that will curb how soon the Fed might cut rates again”. Ultimately, they conclude: “We stay overweight U.S. equities and pro-risk on the AI theme”.

Upcoming Economic Data

Here’s what investors will be keeping an eye on Thursday.

- The initial jobless claims data for the week ending Jan. 10 will be out by 8:30 a.m. ET, along with November’s delayed U.S. import prices data, January’s Empire State manufacturing survey, and the Philadelphia Fed’s manufacturing survey.

- Fed Governor Michael Barr will speak at 9:15 a.m., Richmond Fed President Tom Barkin will speak at 12:40 p.m., and Kansas City Fed President Jeff Schmid will speak at 1:30 p.m. ET.

Commodities, Gold, Crypto, And Global Equity Markets

Crude oil futures were trading lower in the early New York session by 3.36% to hover around $59.75 per barrel.

Gold Spot US Dollar fell 0.38% to hover around $4,609.13 per ounce. Its last record high stood at $4,643.06 per ounce. The U.S. Dollar Index spot was 0.11% higher at the 99.1620 level.

Meanwhile, Bitcoin (CRYPTO: BTC) was trading 2.05% higher at $96,927.28 per coin.

Asian markets closed mixed on Thursday, as India’s Nifty 50, Japan’s Nikkei 225, and Hong Kong’s Hang Seng indices fell. While China’s CSI 300, Australia’s ASX 200, and South Korea’s Kospi indices rose. European markets were mixed in early trade.

Photo courtesy: Shutterstock

Recent Comments