Economist Peter Schiff questioned the sustainability of Bitcoin’s ongoing rally on Wednesday, arguing that investors are mistakenly rotating profits from commodities into cryptocurrency-linked assets.

Schiff Downplays Bitcoin Rally

Schiff suggested in an X post that traders are taking profits in gold and silver mining stocks and buying Bitcoin exchange-traded funds and Strategy.

“That’s a big mistake,” the Bitcoin skeptic stated, urging them instead to cash out of Bitcoin and MSTR and use the proceeds to buy precious metal-linked stocks.

Schiff made a similar call earlier this month, arguing that Bitcoin’s uptick isn’t a bullish sign but just a “pumper” narrative.

Commodities, Crypto Take Off In 2026

Both cryptocurrency and precious metals have taken a solid start to 2026. Unlike gold and silver, Bitcoin remains far from its all-time highs, but the leading cryptocurrency has reclaimed levels not seen since two months ago.

| Asset | YTD Gains +/- |

|---|---|

| Bitcoin (CRYPTO: BTC) | +9.52% |

| Strategy Inc. (NASDAQ:MSTR) |

+18.02% |

| iShares Bitcoin Trust ETF (NASDAQ:IBIT) | +11.66% |

| VanEck Gold Miners ETF (NYSE:GDX) | +12.93% |

| Spot Gold | +6.50% |

| Spot Silver | +23.90% |

Bitcoin’s surge has coincided with geopolitical developments in the Middle East and progress on the cryptocurrency market structure bill, which has spilled over to related stocks, such as MSTR and spot ETFs.

Interestingly, cryptocurrency bettors on Polymarket see a 57% chance that Bitcoin outperforms gold this year.

Price Action: At the time of writing, BTC was exchanging hands at $96,291.02, up 1.04% in the last 24 hours, according to data from Benzinga Pro.

Strategy shares fell 1.63% in after-hours trading after closing 3.66% higher at $179.33 during Wednesday’s regular trading session. iShares Bitcoin Trust ETF (NASDAQ:IBIT) closed up 3.49% higher.

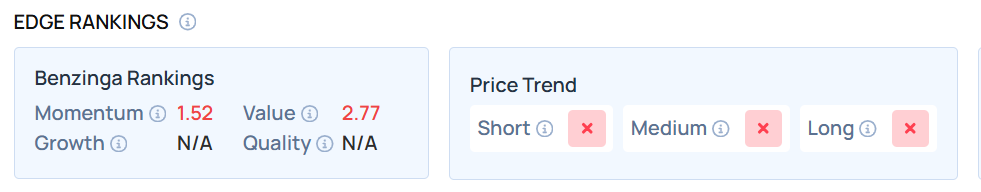

The MSTR stock maintains a weaker price trend over the short, medium and long terms.

Photo by Frame Stock Footage via Shutterstock

Disclaimer: This content was partially produced with the help of Benzinga Neuro and was reviewed and published by Benzinga editors.

Recent Comments