As Gold surges toward the psychological $4,700 mark, hitting an all-time high of $4,640.13, two major royalty and streaming companies are flashing warning signs.

Gold Rally Creates Valuation Paradox

While Franco-Nevada Corp. (NYSE:FNV) and Osisko Gold Royalties (NYSE:OR) are riding the precious metal’s momentum, their stock prices have risen so sharply that they are now considered significantly overvalued relative to their fundamentals.

According to Benzinga Edge data, the “Value” scores for both companies—which measure a stock’s worth by comparing market price to assets, earnings, and sales—have collapsed into the bottom 10th percentile this week.

Value Rankings Plunge Below 10th Percentile

The week-on-week data highlights a rapid deterioration in valuation metrics as investors pile into these stocks:

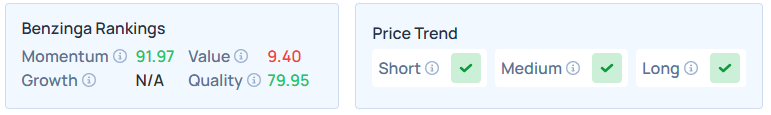

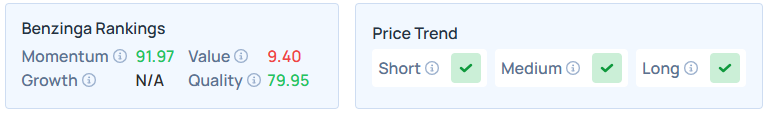

- Franco-Nevada Corp.: The stock’s Value score dropped from 11.27 to 9.40. Additional performance details, as per Benzinga’s Edge Stock Rankings, are available here.

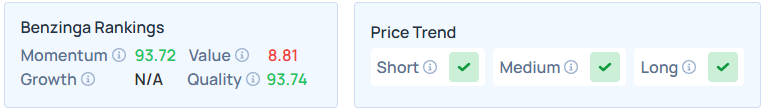

- Osisko Gold Royalties: The drop was even steeper, falling from 10.59 to a scarce 8.81. Additional performance details are available here.

These scores indicate that while the companies are financially robust, their current share prices may be outpacing their underlying financial measures like sales and operating performance.

High Momentum, Low Value

The drop in value scores is ironically a symptom of the stocks’ success. Both companies currently boast massive “Momentum” scores—93.72 for Osisko and 91.97 for Franco-Nevada. Additionally, both stocks show positive price trends across short, medium, and long timeframes.

Shares of FNV have advanced 49.92% over the last six months, 87.66% over the year, and 13.70% in 2026, so far. The stock was 0.89% higher in premarket on Wednesday.

Meanwhile, OR has gained 49.14% over the last six months, 118.58% over the year, and 14.36% YTD. OR was 0.88% higher in premarket on Wednesday.

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

Image via Shutterstock

Recent Comments