The most oversold stocks in the consumer discretionary sector presents an opportunity to buy into undervalued companies.

The RSI is a momentum indicator, which compares a stock’s strength on days when prices go up to its strength on days when prices go down. When compared to a stock’s price action, it can give traders a better sense of how a stock may perform in the short term. An asset is typically considered oversold when the RSI is below 30, according to Benzinga Pro.

Here’s the latest list of major oversold players in this sector, having an RSI near or below 30.

Coursera Inc (NYSE:COUR)

- On Dec. 17, Coursera announced it signed an all-stock merger agreement with Udemy. “We’re at a pivotal moment in which AI is rapidly redefining the skills required for every job across every industry. Organizations and individuals around the world need a platform that is as agile as the new and emerging skills learners must master,” said Greg Hart, CEO of Coursera. “By combining the highly complementary strengths of Coursera and Udemy, we will be in an even stronger position to address the global talent transformation opportunity, unlock a faster pace of innovation, and deliver valuable experiences and outcomes for our learners and customers. Together, we will ensure our millions of learners, thousands of enterprise, university, and government customers, and expert instructors have a platform to keep pace with technology acceleration.” The company’s stock fell around 17% over the past month and has a 52-week low of $5.76.

- RSI Value: 19.8

- COUR Price Action: Shares of Coursera fell 10.6% to close at $6.55 on Tuesday.

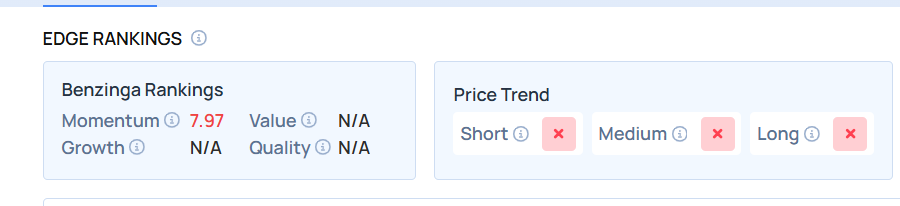

- Edge Stock Ratings: 7.97 Momentum score.

Udemy Inc (NASDAQ:UDMY)

- On Jan. 13, Keybanc analyst Devin Au downgraded Udemy from Overweight to Sector Weight. The company’s stock fell around 10% over the past five days and has a 52-week low of $4.86.

- RSI Value: 28.2

- UDMY Price Action: Shares of Udemy dipped 12% to close at $5.12 on Tuesday.

- Benzinga Pro’s charting tool helped identify the trend in UDMY stock.

ThredUp Inc (NASDAQ:TDUP)

- On Dec. 9, Telsey Advisory Group analyst Dana Telsey maintained ThredUp with an Outperform rating and maintained a $12 price target. The company’s stock fell around 25% over the past month and has a 52-week low of $1.66.

- RSI Value: 29.8

- TDUP Price Action: Shares of ThredUp fell 2.9% to close at $5.94 on Tuesday.

- Benzinga Pro’s signals feature notified of a potential breakout in TDUP shares.

Learn more about BZ Edge Rankings—click to see scores for other stocks in the sector and see how they compare.

Read This Next:

Photo via Shutterstock

Recent Comments