Coca-Cola (NYSE:KO) has decided to halt the sale of its Costa Coffee chain after private equity bids did not meet the company’s expectations, according to a report published Wednesday.

The soft drinks giant ended discussions with remaining bidders in December, including TDR Capital and Bain Capital‘s special situations fund, after a prolonged auction process, the Financial Times reported, citing sources familiar with the matter.

Coca-Cola had targeted proceeds of about $2.5 billion from the sale of Costa, the coffee chain it acquired from Whitbread in 2018 for roughly $5 billion. The decision comes as Henrique Braun is set to replace James Quincey as CEO in March.

Costa’s Struggles Mount

Costa has been facing stiff competition from independent operators and mass-market rivals, which, along with rising costs, have pushed the business into the red.

The coffee chain’s financial performance has been underwhelming, with operating losses more than doubling to £13.5 million ($18.15 million) on revenues of £1.2 billion ($1.6 billion) in 2024.

The decision to retain Costa could lead to a potential write-down in its value on Coca-Cola’s books. But one person familiar with Coke’s thinking told the Financial Times that the company could still revive plans to sell Costa in the medium term.

The company had earlier named supermarket chain Asda‘s owner TDR as the preferred bidder— a deal that would have seen Coke retain a minority stake in Costa. Private equity firms Apollo, KKR, and Centurium Capital, owner of China’s Luckin Coffee chain, were involved at earlier stages of the process, which was handled by Lazard, according to the report.

Coca-Cola, TDR, and Bain Capital did not immediately respond to Benzinga‘s requests for comment.

What’s Going On With KO Shares?

Coca-Cola Co shares were down 0.22% at $71.08 while the market was closed on Tuesday, according to Benzinga Pro. Its shares rose about 12.5% in 2025, while rival PepsiCo’s (NASDAQ:PEP) shares dropped 5.1% in the same period.

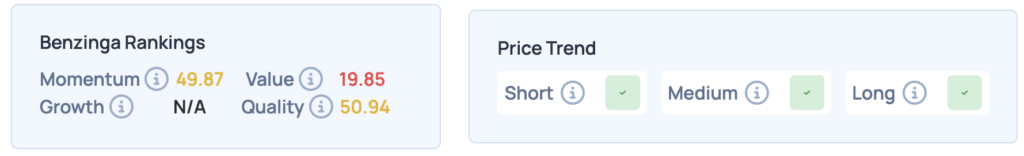

According to Benzinga’s Edge Rankings, the stock shows balanced technical strength, with moderate momentum and quality scores, though value metrics are weak. Price trends across the short, medium, and long-term are bullish.

Image via Shutterstock

Recent Comments