On Tuesday, Deepwater Asset Management’s managing partner Gene Munster said that Apple Inc.’s (NASDAQ:AAPL) switch from OpenAI’s ChatGPT to Alphabet Inc.’s (NASDAQ:GOOG) (NASDAQ:GOOGL) Google Gemini gives Siri a much stronger chance of success.

Apple Partners With Google Gemini To Reinvent Siri

Munster took to X and said, “Odds of new Siri succeeding just went up,” while praising Apple CEO Tim Cook for turning long-standing Siri shortcomings into an opportunity for future device and services growth. “Nice job, Tim Cook.”

Munster said Apple’s move away from GPT — and more broadly, from its reliance on OpenAI — in favor of Google’s Gemini signals that the company is taking a more serious approach to fixing Apple Intelligence.

He added that while GPT is a highly capable model, Apple is aiming to go further and believes it needs a different strategy to do so.

However, Elon Musk, CEO of Tesla Inc. (NASDAQ:TSLA) and xAI, criticized the partnership, warning that it could give Google too much influence given its control over the Android operating system and the Chrome browser.

Leadership Changes Signal Bigger AI Push

In December 2025, John Giannandrea, who had led Apple’s AI efforts since 2018, announced he would step down and assume an advisory role before retiring in 2026.

He is succeeded by Amar Subramanya, a former AI executive at Microsoft Corp (NASDAQ:MSFT) and Google, who contributed to the Gemini Assistant.

Analysts See Growth Opportunities

Over the weekend, Wedbush analyst Dan Ives described the Gemini partnership as a top catalyst for Apple’s AI strategy, predicting it could become the company’s exclusive AI partner.

The move comes as Alphabet surpassed Apple in market capitalization for the first time since 2019. Alphabet’s market capitalization currently stands at about $4.06 trillion, compared with Apple’s roughly $3.84 trillion.

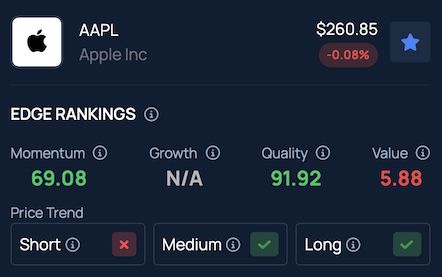

Price Action: On Tuesday, Apple shares closed up 0.31% at $261.05, with the stock slipping slightly to $260.85 in after-hours trading.

Meanwhile, Alphabet’s Class A shares rose 1.24% during the regular session and added 0.38% in after-hours trading, while Class C shares gained 1.11% in the session and a further 0.47% after hours, according to Benzinga Pro.

Benzinga Edge Stock Rankings show that Apple retains a strong medium and long-term outlook despite near-term pressure on its shares. Click here to see how Apple stacks up against its industry peers.

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

Photo Courtesy: Wachiwit on Shutterstock.com

Recent Comments