Leading cryptocurrencies surged on Tuesday as the Senate prepares for the markup of a key bill aimed at regulating the cryptocurrency market.

| Cryptocurrency | Gains +/- | Price (Recorded at 8:20 p.m. ET) |

|---|---|---|

| Bitcoin (CRYPTO: BTC) | +4.43% | $95,374.58 |

| Ethereum (CRYPTO: ETH) |

+7.16% | $3,327.98 |

| XRP (CRYPTO: XRP) | +5.29% | $2.16 |

| Solana (CRYPTO: SOL) | +4.52% | $145.52 |

| Dogecoin (CRYPTO: DOGE) | +8.25% | $0.1482 |

Crypto Market Rebounds

Bitcoin rose above $96,000 for the first time in nearly two months ,with trading volume surging 45% over the last 24 hours. The leading cryptocurrency is now up 9.29% in 2026.

Ethereum also rallied to a 2-month high of $3,350, while XRP and Dogecoin also recorded sharp spikes.

The rally comes after the Senate Banking Committee released a draft bill for the key cryptocurrency market structure bill, defining altcoins as similar to Bitcoin and Ethereum. The Committee marks up the bill Thursday

Shares of cryptocurrency-related companies, including Strategy Inc. (NASDAQ:MSTR) and Coinbase Global Inc. (NASDAQ:COIN), closed up 6.63% and 4%, respectively

Benzinga Edge delivers real-time stock alerts, trade ideas, and professional investing tools to help you navigate the market. Find out more about MSTR and COIN here.

Nearly $680 million was liquidated from the cryptocurrency market in the last 24 hours, according to Coinglass, with $592 million in bearish shorts wiped out.

Bitcoin’s open interest surged 6.65% in the last 24 hours, with more than 50% of derivatives traders placing long bets on the apex cryptocurrency.

The market sentiment shifted from “Fear” to “Neutral,” according to the Crypto Fear & Greed Index.

Top Gainers (24 Hours)

| Cryptocurrency (Market Cap>$100 M) | Gains +/- | Price (Recorded at 8:30 p.m. ET) |

| Pirate Chain (ARRR ) | +23.75% | $3.04 |

| Dash (DASH ) | +45.06% | $58.48 |

| Story (IP ) | +27.10% | $3.85 |

The global cryptocurrency market capitalization stood at $3.25 trillion, jumping 4.67% over the last 24 hours.

Stocks Move The Other Way

Stocks pulled back from record highs on Tuesday. The Dow Jones Industrial Average retreated 398.21 points, or 0.8%, to end at 49,191.99. The S&P 500 dipped 0.19% to settle at 6,963.74, while the tech-focused Nasdaq Composite lost 0.1% to finish at 23,709.8

December’s Consumer Price Index rose 2.7% year over year, in line with analyst estimates. On a monthly basis, consumer prices increased 0.3%, also in line with forecasts.

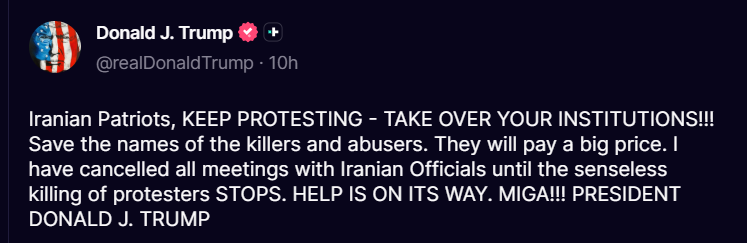

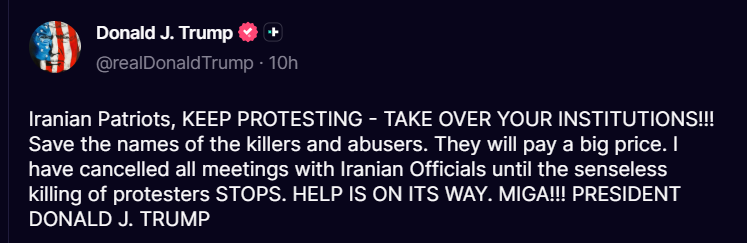

Oil prices lifted, with the U.S. West Texas Intermediate trading surging beyond $61 a barrel as geopolitical tensions rose after President Donald Trump told Iranian protesters that “help is on its way.”

Shares of defense companies, including Lockheed Martin Corp. (NYSE:LMT) and Kratos Defense & Security Solutions, Inc. (NASDAQ:KTOS), closed down 4.34% and 13.78%, respectively, after President Donald Trump said he wants to increase the 2027 military budget from $1 trillion to $1.5 trillion.

Bull Market About To Start?

Michaël van de Poppe, a widely followed cryptocurrency analyst and trader, noted Bitcoin’s breakout above the crucial 21-day moving average and test of the level as support.

“It’s quite clear that this is going to run to $100,000 in the coming week and that dips are for buying,” the analyst projected. “The bull market hasn’t died, it’s about to start.”

Similarly, popular analyst Ali Martinez predicted that $105,921 “comes into play” if the apex cryptocurrency crosses $94,555.

As of this writing, Bitcoin has cleared this threshold and remains to be seen whether it hits Martinez’s target.

Photo Courtesy: Sodel Vladyslav on Shutterstock.com

Recent Comments