The most oversold stocks in the communication services sector presents an opportunity to buy into undervalued companies.

The RSI is a momentum indicator, which compares a stock’s strength on days when prices go up to its strength on days when prices go down. When compared to a stock’s price action, it can give traders a better sense of how a stock may perform in the short term. An asset is typically considered oversold when the RSI is below 30, according to Benzinga Pro.

Here’s the latest list of major oversold players in this sector, having an RSI near or below 30.

Rogers Communications Inc (NYSE:RCI)

- On Jan. 8, Rogers launched a five-year $50 million national program to help youth balance screen time. “Connectivity brings us together and it connects us to the world around us, but excessive screen time is a real concern for our customers,” said Tony Staffieri, President and CEO, Rogers. “Our customers want help managing screen time and Screen Break is our commitment to help young people build a healthier, balanced relationship with their screens.”

- The company’s stock fell around 3% over the past month and has a 52-week low of $23.18.

- RSI Value: 23.6

- RCI Price Action: Shares of Rogers Communications fell 1.6% to trade at $35.74 on Tuesday.

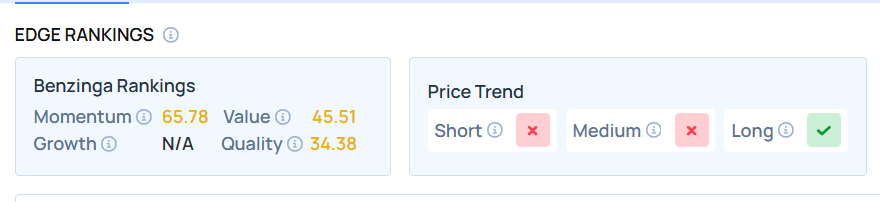

- Edge Stock Ratings: 65.78 Momentum score with Value at 45.51.

Netflix Inc (NASDAQ:NFLX)

- On Jan. 12, HSBC analyst Mohammed Khallouf initiated coverage on Netflix with a Buy rating and announced a price target of $107. The company’s stock fell around 4% over the past month and has a 52-week low of $82.11.

- RSI Value: 28.9

- NFLX Price Action: Shares of Netflix rose 0.3% to trade at $89.68 on Tuesday.

- Benzinga Pro’s charting tool helped identify the trend in NFLX stock.

AT&T Inc (NYSE:T)

- On Jan. 13, Barclays analyst Kannan Venkateshwar maintained AT&T with an Equal-Weight rating and lowered the price target from $28 to $26.. The company’s stock fell around 4% over the past five days and has a 52-week low of $21.38.

- RSI Value: 29.7

- T Price Action: Shares of AT&T fell 1.7% to trade at $23.32 on Tuesday.

- Benzinga Pro’s signals feature notified of a potential breakout in T shares.

Learn more about BZ Edge Rankings—click to see scores for other stocks in the sector and see how they compare.

Read This Next:

Photo via Shutterstock

Recent Comments